With renewed popularity for the euro and the US dollar’s cautious anticipation of US job numbers, the EUR/USD corrected upwards to the 1.1857 resistance level before settling around 1.1840 as of this writing. While many in the market still maintained bearish views on the medium-term outlook for the euro, rising hopes for a possible fourth-quarter policy shift at the European Central Bank (ECB) worked in tandem with fresh dollar drops to discourage further bets against the currency this week.

On Wednesday, German Central Bank President Jens Weidmann was the latest member of the Governing Council whose comments supported the emerging view that the ECB is likely to reduce in the coming months the volume of weekly government bond purchases being carried out under the Pandemic Emergency Purchase Program, the banner under which quantitative easing is implemented for reasons inspired by the coronavirus.

In a speech on Wednesday, President Weidmann reiterated the already known preference that the ECB's PEPP program be terminated once the coronavirus crisis is over, but made this clear by suggesting that weekly purchases should be phased out slowly rather than abruptly halted. Comments indicate a preference for a "tapping" process, which must inevitably begin before the March 2022 date when some economists estimate that 1.85 trillion euros for the program will be exhausted, not out of sync with the rhetoric of other European Central Bank officials.

Commenting on this, Anders Svendsen, chief analyst at Nordea Markets says, “Draghi recalled at the December 2016 board meeting explaining why the slowdown in the pace of purchases had not decreased from 80 billion/month to 60 billion/month because there was no plan to continue deceleration to zero, Chair Lagarde is likely to use the same play-guide at next week's meeting if the ECB decides to return to the "normal" pace of PEPP purchases from the "significantly higher" pace in the second and third quarters."

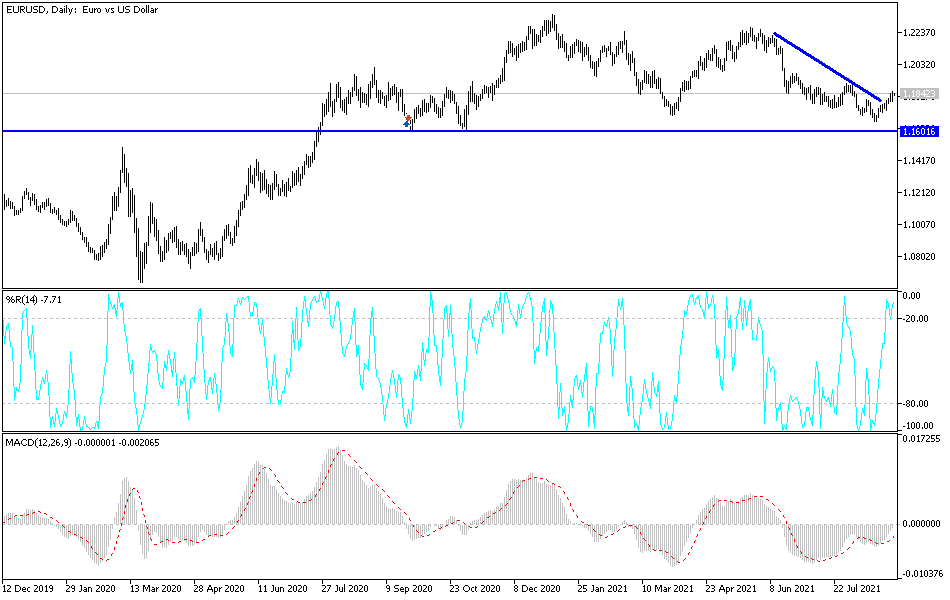

Technical analysis of the pair

On the daily chart, the EUR/USD is moving within its ascending channel that was formed recently, and the bulls are currently waiting to move it to the psychological resistance level of 1.2000 to confirm the turn of the general trend to the upside. On the other hand, the support levels 1.1770 and 1.1680 would enable the bears to return. The currency pair may maintain its bullish momentum until the US jobs numbers are released on Friday.

Today, the Producer Price Index reading in the Eurozone will be announced. Then the announcement of the numbers of the US trade balance, the claims of the unemployed, the non-agricultural productivity, and statements by some officials of the US Federal Reserve will be released.