This week opened like last week closed, as the EUR/USD continued to correct lower towards the 1.1770 support level, the lowest in more than two weeks. It is stable around 1.1810 as of this writing. I mentioned a lot in the technical analysis about the importance of the 1.1800 level to separate the two trends. The recent recovery of the currency pair suffered a setback due to a group of local and international factors that left the prospects for the euro dependent on the market's appetite for the dollar during the coming period. The EUR/USD fell for four out of five days last week as repeated bouts of risk aversion in global markets increased demand for the US currency and weighed on the EUR.

The euro has ebbed even as the latest GDP figures have been raised and the European Central Bank has slightly reduced the amount of government bonds it intends to buy each month under the Pandemic Emergency Quantitative Easing Program. Meanwhile, Eurostat reconfirmed GDP growth at 2.2% instead of 2% as initially estimated, while the European Central Bank also raised several of its forecasts for this year and beyond.

The European Central Bank also announced smaller steps for quantitative easing for the fourth quarter, although this did little for the EUR/USD, which fell from levels close to 1.19 to test 1.18 and below.

Meanwhile, the dollar rallied after two weeks of declines and as investors consider several risks to the global economic outlook, despite governments' responses to the coronavirus outbreak around the world. The extent to which these factors fuel further demand for the dollar will determine whether the euro is still holding in the 1.18-1.19 range indicated by ING's Turner this week, or if instead it is looking for a breakout in either direction.

Also, EUR/USD appears to have been stabilizing since late August and analysts at Commerzbank are looking for a bottom above 1.1750 before making a final attempt to regain the 1.20 level. Karen Jones, Head of Technical Analysis for Currency, Commodities and Bonds at Commerzbank, says: “We continue to favor an eventual extension towards 1.1990/1.2014 August 2020 high and 200-day high 1.1790.” Jones and the Commerzbank team have been recent buyers of EUR/USD and have noticed technical support levels below there around 1.1704 and 1.1664, the lows from March and August.

This week is quiet for the Eurozone economic data, but it does show US inflation and retail sales numbers for August, although these have little direct impact on the pending decision by the Fed on what to do on its quantitative easing program. This in turn suggests that the fluctuation in investors' appetite for riskier currencies may ultimately be the most pervasive impact on the EUR/USD rate this week, which in turn is highly dependent on short-term coronavirus developments.

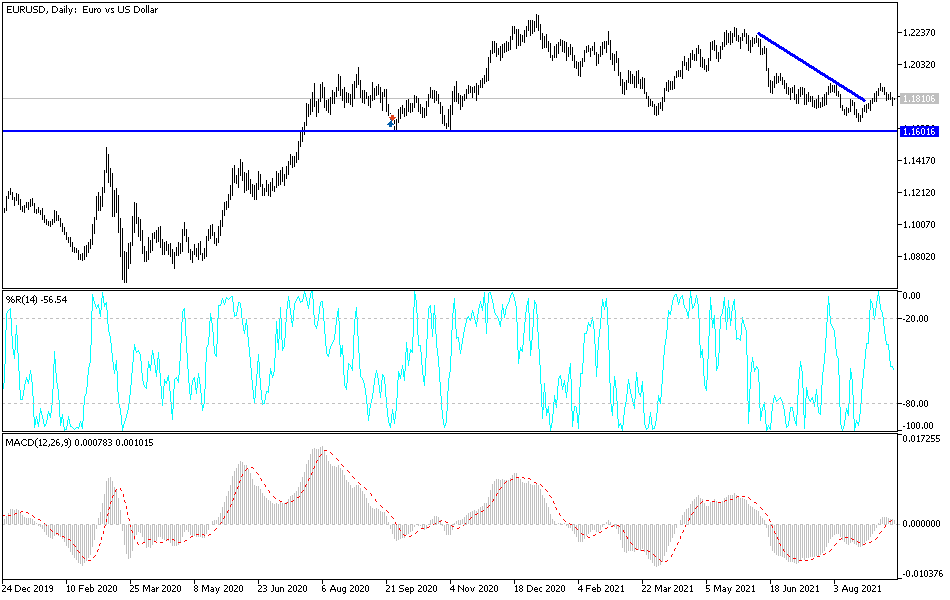

Technical analysis of the pair

Moving below the 1.1800 level motivates the bears to move towards support levels at 1.1755 and 1.1680, the latter being appropriate for buying. On the upside, the psychological resistance 1.2000 is still key for bulls to control the trend.

There are no significant European releases today. From the United States, the Consumer Price Index for US inflation will be announced.