The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

There are a few strong valid long and short-term trends in the market right now, so it is a good time to be trading to take advantage of that.

Big Picture 26th September 2021

Last week’s Forex market mostly moved weakly counter to most prevailing trends. The Japanese yen was weak while the US dollar, Canadian dollar, and Swiss franc were strong. Global stock markets recovered from a dip.

I wrote in my previous piece last week that the best trades were likely to be short of the AUD/USD currency pair taking a swing trading style, and long of the USD/CHF currency pair with short-term day trades. This probably would have given a mixed outcome as the AUD/USD currency pair fell over the week, but the USD/CHF currency pair failed to rise.

Fundamental Analysis & Market Sentiment

The headline takeaway from last week were mildly hawkish tilts from the Federal Reserve on the USD and the Bank of England on the GBP. This sent yields higher, with the yield on the US 10-year treasury surpassing 1.45% for the first time since July. Global stock markets mostly recovered over the week, with the bearish Chinese market a notable exception. Perishable commodities are rising, with WTI Crude Oil’s breakout to close at a new 50-day high on Friday leading the way there.

This week’s schedule will be dominated by US and Canadian GDP data, but apart from these economic releases, scheduled events look very light. There is a federal election in Germany today and the opinion polls show the two major parties are closely tied. The election will determine the successor to Angela Merkel, who has been in office for the last sixteen years.

We are seeing an increase in supply chain disruptions, most notably in recent days within the UK where it has been hard for motorists to find retail gasoline for sale over the past days.

Last week saw the global number of confirmed new coronavirus cases fall for the fifth consecutive week after previously rising for more than two months, with deaths lower for the fourth consecutive week. Approximately 44.3% of the global population has now received at least one vaccination.

The strongest growths in new confirmed coronavirus cases right now are happening in Barbados, Belarus, Croatia, Egypt, Estonia, South Korea, Laos, Latvia, Lithuania, Moldova, Romania, Russia, Slovakia, and the Ukraine.

Technical Analysis

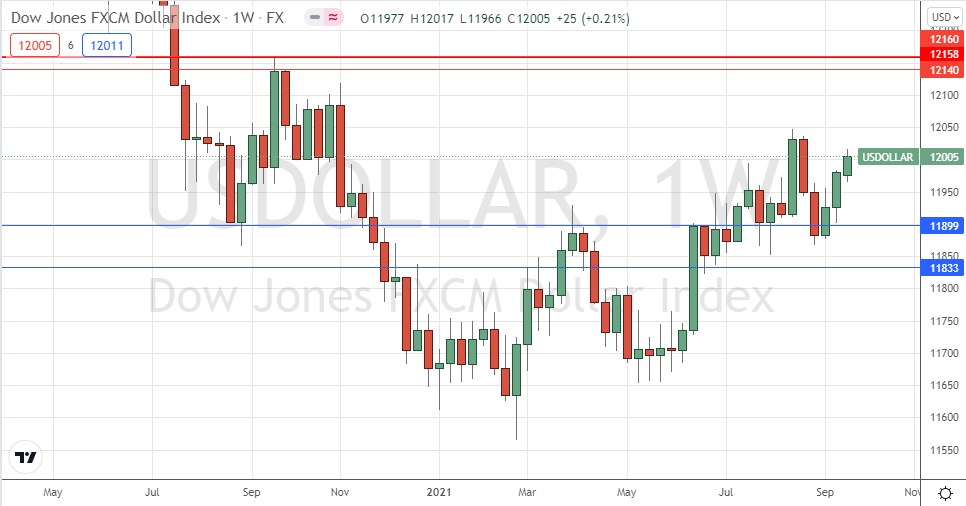

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed another bullish candlestick last week after having rejected the zone of support which I had identified between 11899 and 11833. The price is above the levels from 3 and 6 months ago, which shows that the long-term bullish trend in the greenback is still valid. We also have some bullish momentum evidenced by the fact that the weekly candlestick closed not far from the top of its range. This suggests that trades in the USD look better on the long rather than short side right now, so the best strategy in the Forex market over the coming week will probably be to look for long trades in US dollar currency pairs.

WTI Crude Oil

WTI Crude Oil closed Friday at a new 50-day high price. This is a bullish sign and many trend-following hedge funds will be buying WTI Crude Oil futures on Monday. However, bulls should be warned that the multi-month price action remains rectangular shaped, as can be seen by the chart below, with the $76.38 level above the current price quite likely to act as resistance. Nevertheless, the price is more likely than not to rise over the very short term.

GBP/USD

The GBP/USD currency pair is looking heavy as it has again fallen to test the pivotal 1.3600 area for the third time since July. This pattern is likely to produce either a significant bearish breakdown in line with the bearish trend or give another bullish reversal from the 1.3600 area which could become a long-term bullish triple bottom.

A daily close of a firm bearish candlestick below 1.3600 could be a good short trade entry signal.

Silver (XAU/USD)

Silver broke down to new long-term low daily closing prices last week, although the low if its recent spike down has not yet been exceeded. The price action is clearly bearish although the price was reluctant at the end of the week to close at a significant low. Nevertheless, the trend is clearly bearish, and a daily close below $22.25 would be a bearish signal indicating that a short trade entry could be appropriate here. The bearish case for Silver is helped by the fact that Gold is also looking weak, albeit less so.

Bottom Line

I see the best opportunities in the financial markets this week as likely to be short in Silver and the GBP against the USD once new low daily closing prices have been made, as I outlined above.