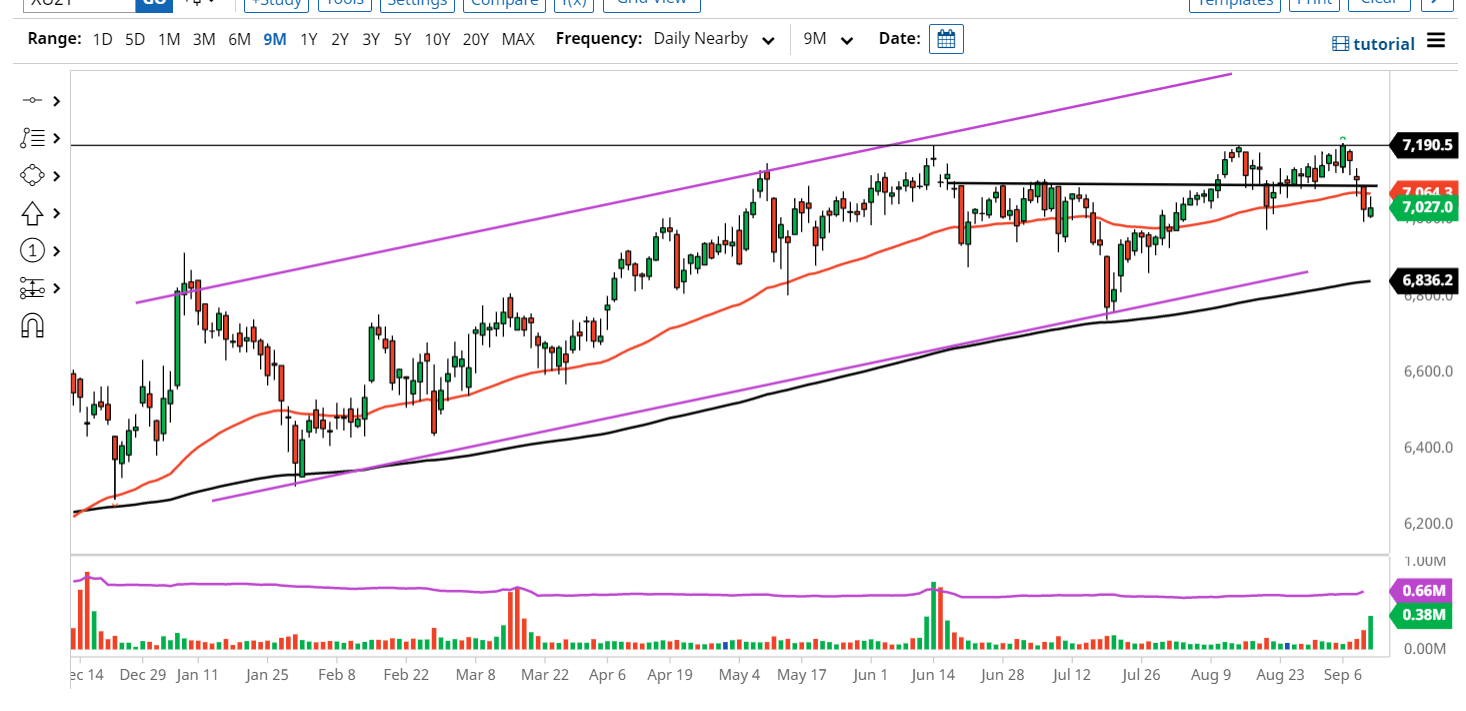

The FTSE 100 initially tried to rally on Friday but gave back the early gains to form a bit of an inverted hammer. This follows three very negative trading sessions, as we now find ourselves sitting on top of the 7000 level. It is worth noting that this market has plenty of support underneath, but one should also keep in mind that we have fallen quite far in a very short amount of time.

It is because of this that I believe the next couple of sessions will be crucial for the future of this market. Once we get the next couple of days out of the way, we should set up for a bigger move. On one hand, if we were to turn around and wipe out the highs of the Friday session to the upside, that could send this market looking towards 7200 again. It would be a very bullish sign, and I suspect that more money would come flowing in. Alternately, if we break down below the 6950 handle, it's very likely that the market will then accelerate to the downside, just as I see other ones potentially doing in the near future.

That's another thing that is worth noting: there have been signs of weakness in multiple stock markets around the world. It's not just in the United Kingdom, but in the United States, France, and many others. With that in mind, you need to keep an eye on several major indices, as they all tend to move in the same general direction over the longer term.

Unlike in the United States, I am willing to short the British markets, because they are not as highly manipulated as the S&P 500 or the NASDAQ 100. Although the Bank of England will almost certainly say something if the markets start falling apart, they aren't as direct about it as the Federal Reserve. The markets will continue to be choppy regardless, but as people start to worry about the delta variant again, this is going to weigh up on stock markets. Furthermore, you have to think that a lot of the future earnings have already been priced in, as most markets have gone straight up in the years into the pandemic.