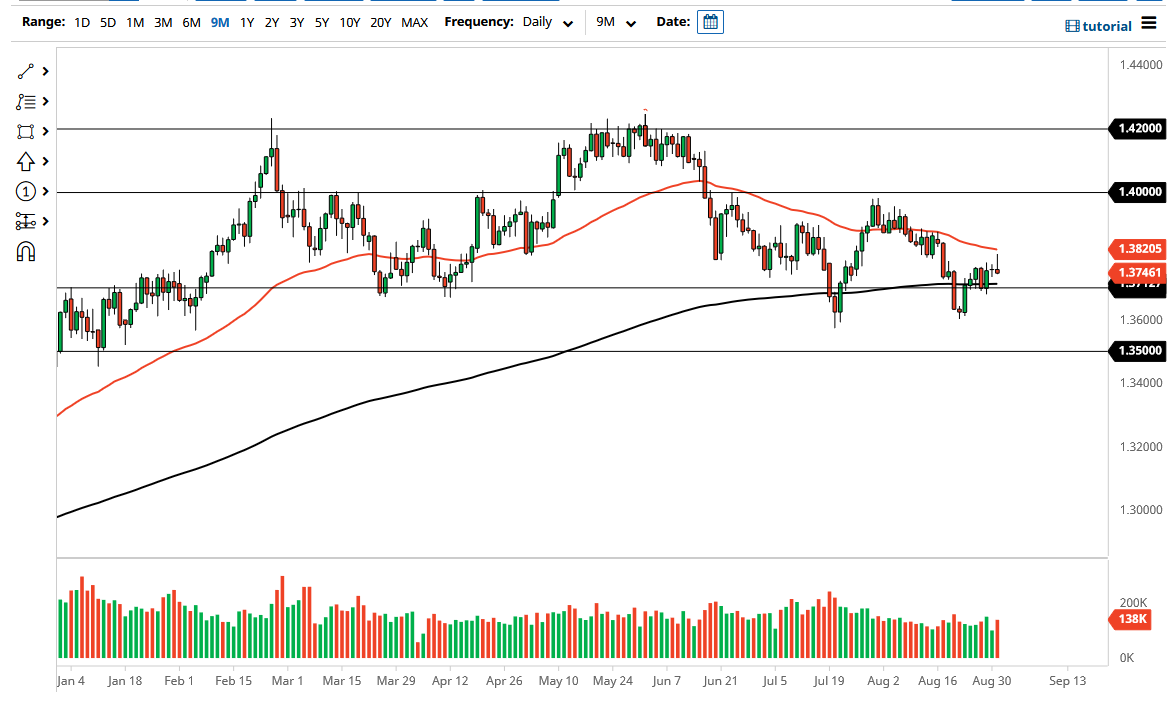

The British pound rallied a bit on Tuesday but gave back the early gains to form a shooting star. This suggests that we are going to see a little bit of a pullback, as we continue to hang around the 200-day EMA. The 200 day EMA is sitting just above the 1.37 handle, which is an area that has been crucial more than once, so I think at this point we could probably see a lot of noisy behavior.

Furthermore, we have the jobs number coming out on Friday, which will probably keep the market somewhat quiet, as we see the market chop back and forth in confusion. At this point, the market looks as if it is trying to figure out what we are about to do, and it is obvious that the 50-day EMA above has offered enough resistance to turn things around and form a bit of a shooting star. If we can break above that level, then it is likely that the market could go looking towards the 1.40 handle. Ultimately, this is a market that had previously formed a bit of a double bottom, and we are trying to see whether or not we can break through it. If we can, then we could go looking towards the 1.35 handle underneath, which could be the gateway to break down rather significantly.

I think the only thing you can probably count on in the short term is a lot of noisy behavior from the US dollar, but probably very tight ranges are what you are going to expect between now and the announcement on Friday. This is a market that I think is winding up to build up a certain amount of momentum, and we will eventually get some type of significant impulsive candlestick in order to tell us where we are going next. Until then, I anticipate that this is going to be a very short-term basis trading environment, as the market will continue to be quiet due to the fact that this is the biggest holiday week of the summer as well, so liquidity would also be another issue.