The GBP/USD tried to correct upwards by breaking through the 1.3800 resistance, but fell back to settle around 1.3770 as of this writing. It seems that the pound has not yet gained the momentum to enable stronger upward levels. The currency pair rose in the wake of disappointing US data that eased pressure on the US Federal Reserve to announce an imminent withdrawal of monetary stimulus.

The US dollar was softer against the other major currencies, after the release of the ADP Non-Farm Employment Report for the month of August, which came in at 374K, much lower than the consensus forecast for a reading of 613K. The data suggest that the US economic recovery may slow as economists blame a spike in COVID-19 cases. Ian Shepherdson, chief economist at Pantheon Macroeconomics, comments that “the ADP is well below the official figure in July, for reasons that are not entirely clear” and “the wave of Delta COVID is likely to be blamed; the hit to consumer spending on discretionary services is visible in near real-time data.”

“The pound rose towards a two-week high against the dollar after Delta seemed to be raising its head in the latest US jobs figures,” said Joe Manimbo, senior market analyst at Western Union Business Solutions. The British pound benefited from the dollar's decline after the ADP employment report showed an increase in private sector hiring by 374K in August.

The slowdown in the US labor market recovery will ease pressure on the US Federal Reserve to announce plans to scale back its quantitative easing (tapering) program at its September policy meeting, and may choose to wait until November to do so. The dollar was supported through 2021 by expectations that the Fed will cut monetary stimulus, so any delay in this agenda will hurt the dollar's rally.

US Federal Reserve Chairman Jerome Powell's speech at the Jackson Hole symposium proved supportive of investor sentiment and negative for the dollar in this regard, as no clear timing was provided on when the Fed would gradually ease its asset purchase program.

But the real blow to the dollar bulls was Powell's warning that there would be no rush to raise interest rates once the program finally stopped. For the dollar to rise significantly, markets will want to see strong incoming economic data that reinforce the view that the Fed can go ahead with tapering and eventually raise rates.

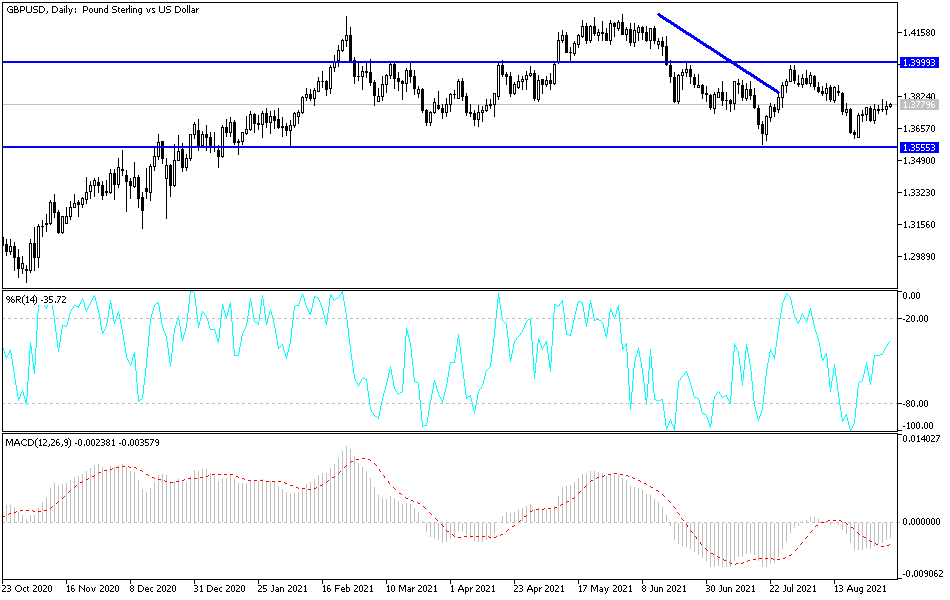

Technical analysis of the pair

The recent bounce put the price of the GBP/USD in a neutral position, and the general trend will not turn bullish without testing the 1.4000 psychological resistance. At the moment, the support levels at 1.3710, 1.3655 and 1.3580 will confirm the bearish trend. The daily chart is in a neutral position with a bearish slope.

The currency pair will be affected today by risk appetite as well as the reaction to the announcement of the US trade balance figures, jobless claims, non-farm productivity and statements by some US Federal Reserve officials.