Gold markets have been all over the place during the trading session on Thursday as the market has been stabilizing after the recent selloff. Quite frankly, gold is going to continue to be all over the place in the short term, because we had seen so much in the way of selling pressure. After all, that big candlestick that we had seen form on Tuesday is the kind of candlestick that can kick off a new leg lower.

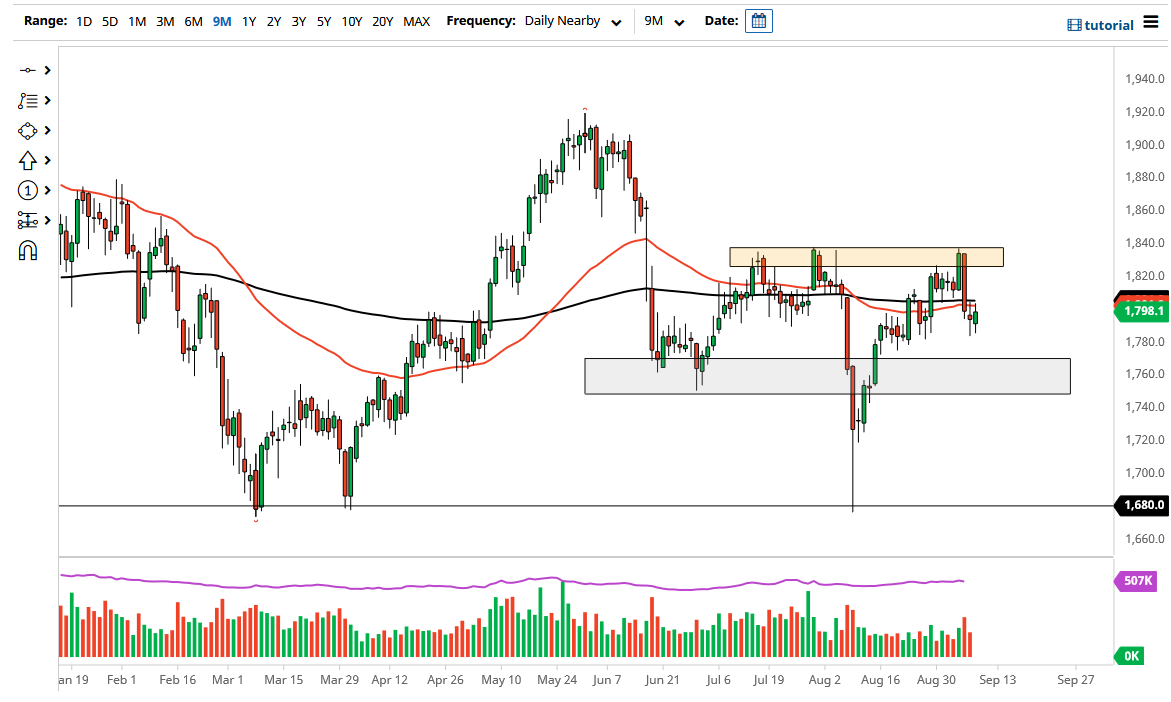

This does not necessarily mean that the market needs to melt down, nor does it even mean that we have to go lower. Having said that, the $1775 level continues to be supportive, and the fact that we are hanging around the $1800 level should not be a huge surprise, as the 50 day EMA and the 200 day EMA both sit there. The $1800 level of course is a large, round, psychologically significant figure, which in and of itself will attract a certain amount of attention.

The neutral and confused looking candlestick from the Wednesday session is worth paying close attention to, and if we break above it, there would be a technical buying signal. However, I think that the $1835 level is continuing to offer massive resistance, and we will not have any significant move to the upside until we can take that out with a daily candlestick. You can see that this area has been very difficult to overcome multiple times, as we have tested it at least six times that I see on the chart. Because of this, I think that is the easiest trade to take, simply buying a breakout above that level. Needless to say, we are not near that area so that more of a longer-term view.

Keep in mind that the gold market tends to move with a highly negative correlation to the US dollar, and therefore I think that the US Dollar Index needs to be paid close attention to, and as if it were to rally, then gold almost certainly would fall by proxy. It should also be noted that Christine Largarde sent the gold markets all over the place during the course of the ECB press conference, so even though the candlestick itself looks somewhat stable, when you drill down to shorter time frames, you can see just how hectic the day was.