The gold market initially pulled back just a bit on Tuesday but turned around to show signs of strength again. We broke above the $1775 level, an area that had been short-term support and resistance. That being said, we still have that nasty red candlestick from last week that shows signs of significant negativity. Furthermore, if the US dollar continues to strengthen, then it makes sense that the gold market will break down.

The market continues to be very noisy, and you have to pay close attention to the overall attitude of the US dollar to get an idea as to what could happen with gold. Furthermore, if interest rates were to suddenly take off to the upside in America, then it is likely that we would see gold markets fall apart, due to the fact that the US dollar would be in demand with rates offering quite a bit of support for that theory. Furthermore, if you get some type of real rate of return when it comes to holding paper, then it becomes much cheaper than trying to store gold.

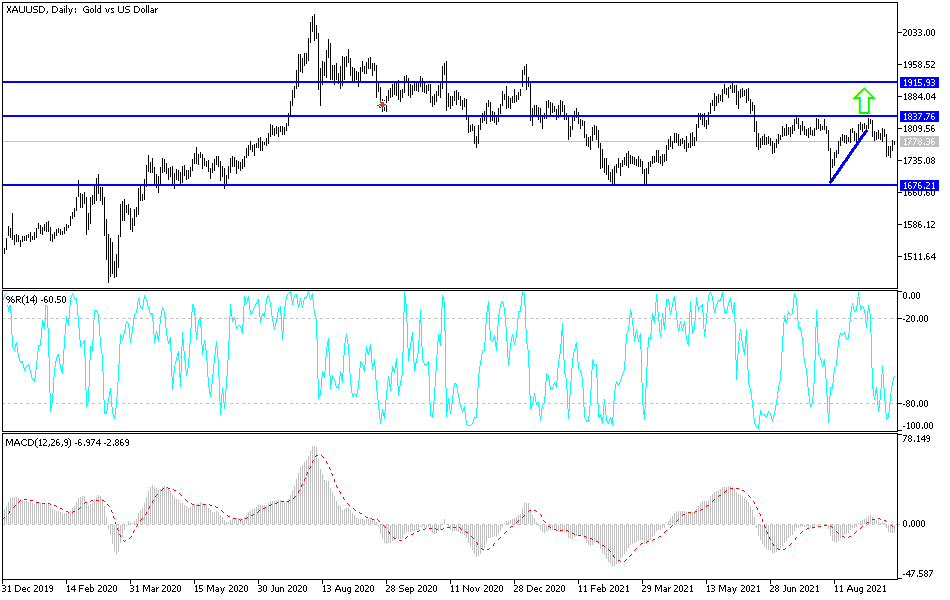

To the downside, the $1750 level underneath is a significant support level, and if we were to break down below it, the market would almost certainly get hammered. At that point, I would anticipate that the market could go looking to the $1680 level, which is where we had seen the market bounce from multiple times. If we break down below there, then the market would fall apart at that point in time.

However, if we were to turn around and break above the 200-day EMA and the $1805 level, then the market is likely to go looking towards the $1835 above, which is a significant barrier. Anything above there could open up a huge move to the upside, but right now I do not necessarily think it is going to be easy to happen. With that being the case, the market is likely to see a lot of back and forth action in this general vicinity, but it should see a significant amount of downward pressure more than anything else. With this in mind, I am looking for signs of exhaustion to sell at the moment.