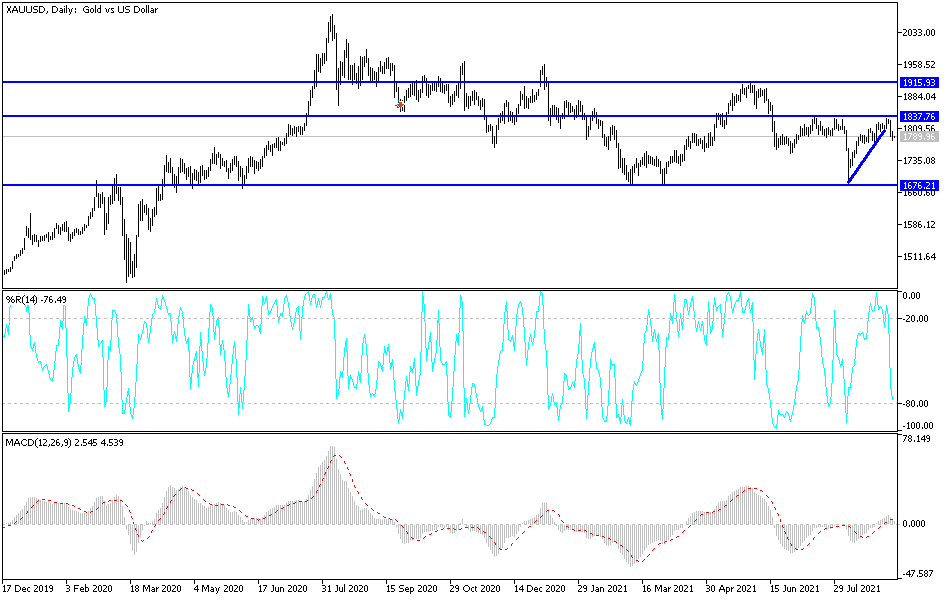

Gold markets were very noisy on Wednesday, essentially standing still with a slightly negative tilt. The $1775 level is a major support level, so it will be interesting to see whether or not it holds. Furthermore, it is worth noting that we had rallied a bit during the session on Wednesday but got hammered at the 200-day EMA as gold continues to see issues.

Taking a look at the candlestick from the Tuesday session, those types of massive negative candlesticks very rarely happen in a vacuum, and because of this I would anticipate that there are plenty of sellers waiting to get into the market. Obviously, the gold market is highly sensitive to the US dollar with an extreme negative correlation under most circumstances. It is because of this that I will be watching the US Dollar Index to get an idea of where we may go next. With that in mind, this neutral candlestick tells me that people have no idea what to do, which makes sense considering that central banks are all over the place right now.

Pay attention to interest rates in America, because if they start rising rapidly, that means that you will get more safety buying paper than you will gold, meaning that you do not have to pay a massive storage fees. That makes gold very unlikely to rally, especially if real interest rates are relatively positive. Quite frankly, we are in a bit of a mess right now, and the last couple of days show you just how uncertain everything is.

On a positive note, if we can break out above the $1835 level, I would be extraordinarily bullish of this market as it is an area that has been like a brick wall for buyers. Clearing that would probably cause a massive, short covering rally, sending the sellers scrambling. That could open up a move towards the $1900 region. To the downside, if we were to turn around and break down below the $1775 level, the $1750 level would get targeted rather quickly, and then perhaps a move down to the massive floor at the $1680 level. Regardless, I think the one thing you can count on is choppy behavior as we have fallen quite significantly, but probably ran out of momentum in the short term.