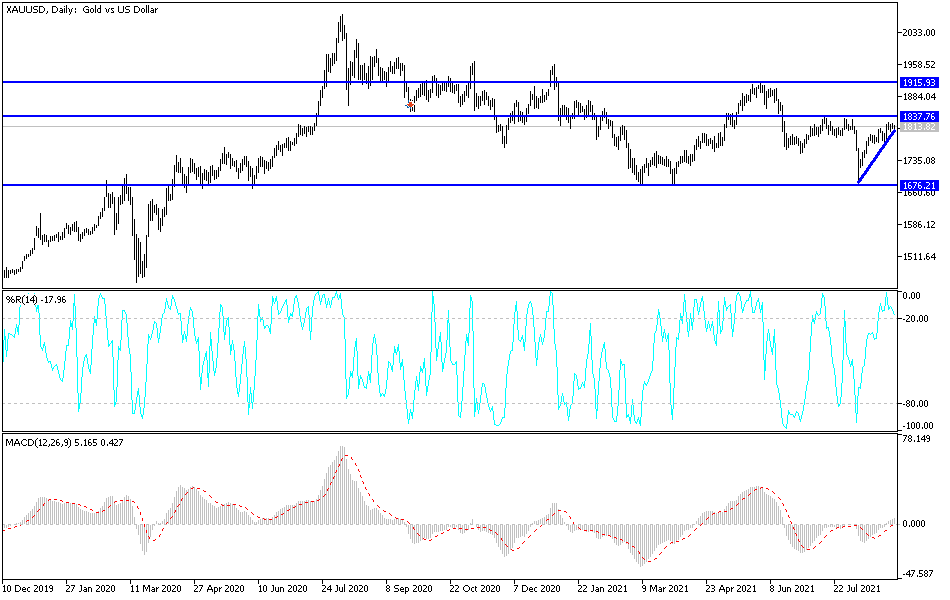

Gold markets fluctuated on Wednesday as we hang about just below the significant resistance zone that extends from $1825 to the level of $1835. With this, I think it is going to take something special to break above there, and I would be surprised to see it happen between now and the jobs number. Remember that the jobs number comes out on Friday, and therefore the markets will probably be quiet between now and then.

The 200-day EMA currently sits just below and offered support during the previous session. Because of this, the market is going to continue to see that as a potential support level. If we were to break down below the 200-day EMA, then we would go looking towards the $1800 level next, which would be the 50-day EMA as well. Because of this, the market is likely to see that entire area is a major support zone, and difficult to break above. Because of this, I think what we are going to see is the market find plenty of buyers underneath.

Pay close attention to the US Dollar Index, which has a major influence on gold and what happens next. If the US dollar strengthens, that might be enough to send gold down towards the support levels, perhaps even breaking down below that area which could open up towards the $1775 area underneath. On the other hand, if the US dollar falls apart, then we could see the gold market break above the $1835 level, opening up the possible move towards $1865, followed by the $1910 level.

In general, I think we are simply killing time until we at least get the jobs number, or perhaps even get more volume coming later this month. After all, this particular week happens to be the biggest holiday week of the summer, so it does make sense that we would have nowhere to be in the short run. That being said, we are clearly building up the momentum for a bigger move, so it is simply a matter of time before we get a move that tells us which direction we are going. If you are a short-term trader, you can probably go back and forth on shorter time frames.