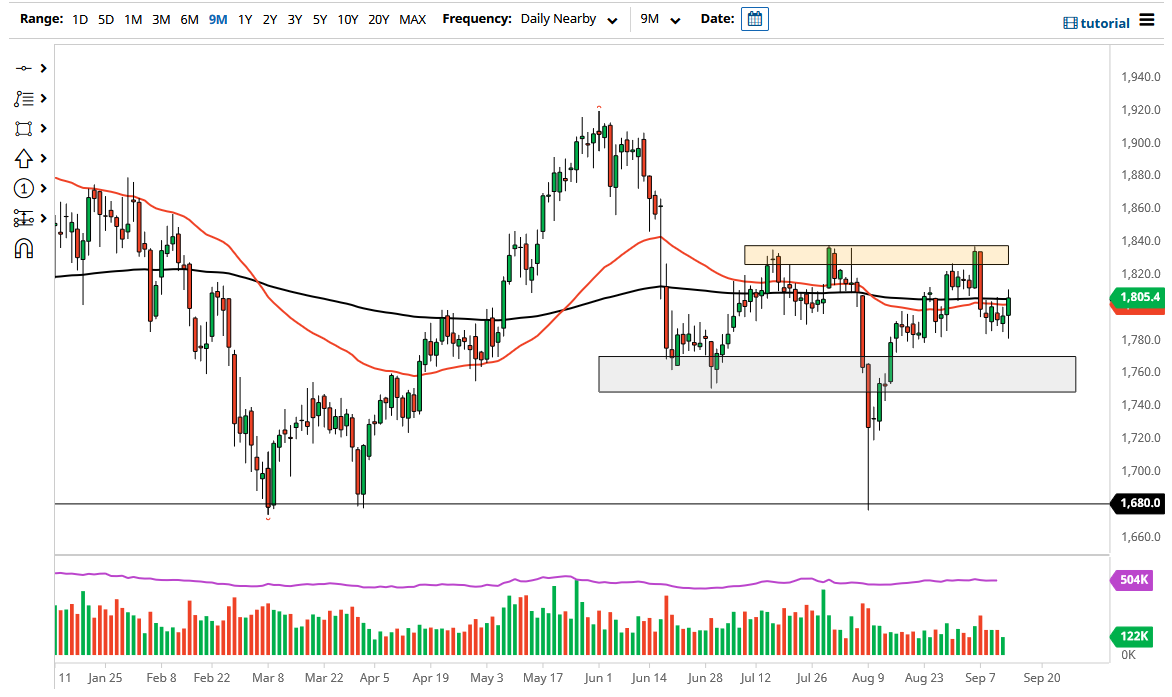

Gold markets initially fell on Tuesday to reach towards the support level near $1775. However, we have turned around to show signs of strength as CPI numbers fell apart and came in much lower than anticipated in the United States. This had a lot of negativity in the greenback, which has a lot of influence on what happens with gold.

The market has ended up forming a major long wick at the bottom of the candlestick, which does suggest that we are going to continue to see a little bit of upward pressure. However, it should also be noted that we pulled back from just above the 200-day EMA, so that could be a little bit of trouble as well. In other words, I think that we are going to continue to see a lot of noisy trading, and now it is going to come down to what happens with interest rates in the United States.

The candlestick is a major hammer, and that does suggest that we are going to eventually go to the upside and go looking towards the $1835 level. That is an area that has been major resistance previously, and now you should be paying close attention to the overall attitude of markets, as we could get in trouble in that general vicinity. However, if we were to break above that area, then the market would go looking towards the $1865 level, followed by the $1900 level. This is a market that I think looks like it is trying to form a little bit of an “inverted head and shoulders”, which is something that you most certainly have to pay close attention to.

On the other hand, if we were to turn around and break down below the $1775 level, then it is likely we will go looking towards the $1750 level, and then maybe even as low as the $1680 level where we had seen a massive amount of support previously. Pay close attention to the value of the US Dollar Index, because it is very likely that you will have a massive negative correlation as per usual. The market has been very noisy as of late, but this is by far the most impressive candlestick since the massive selloff from last week.