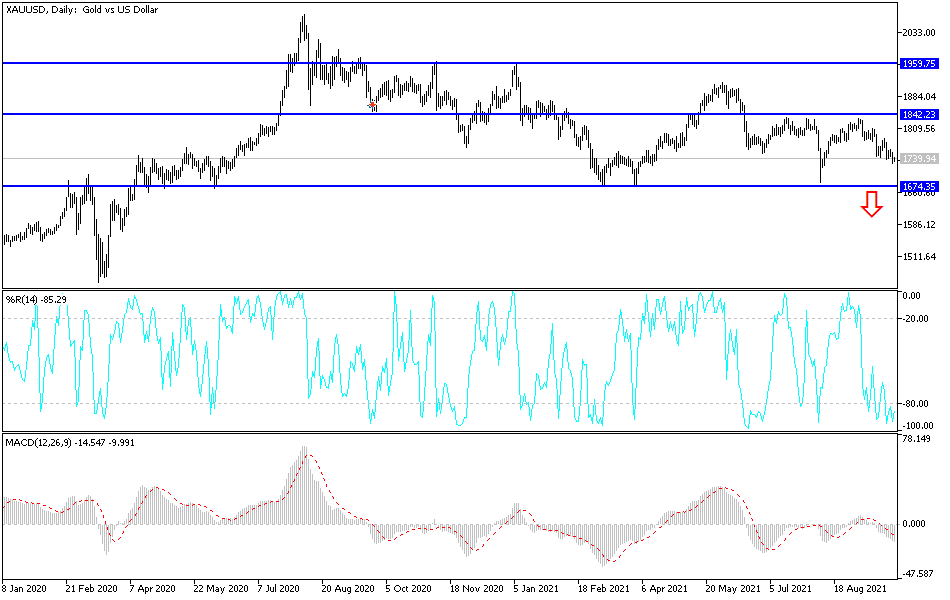

Gold markets broke down a bit on Tuesday to slice through the $1740 region, an area that has been supportive for a while. By doing so, it suggests that there is a lot of weakness coming to the gold market going forward, which makes sense considering that yields have risen so quickly in America. At this point, it is very likely that those yields rallying will continue to work against gold overall, as the cost of storage is rather prohibitive when it comes to owning gold. Furthermore, the market needs to pay close attention to the US dollar itself because a rising dollar tends to work against gold as well.

I do not like buying gold at this point, at least not until we can break above the neutral candlestick that formed in the middle of last week. That means that the market needs to not only rally from here, but it needs to overcome the $1787 level for me to consider going long. At that point, I simply just do not trust the market enough to think that we are going to simply go higher without any issues, so even if we do break out in a rather bullish move, I think that we have a lot of work to do. The US dollar would have to get absolutely crushed in order to make that happen, and yields would have to drop quite drastically. I think gold continues to be a major headache for a lot of traders right now, but clearly the easiest path has been to the downside for a while.

If we break down below the bottom of the candlestick for the trading session on Tuesday, then it is very likely that we will go looking towards the lows of the $1680 level underneath. That is an area that has been massive support for a while, and I do think that breaking down below there would be crucial, as it would open up a move down to the $1500 level quite quickly. That would obviously be a big move, and it is possible that we could see the market meltdown at that point. On the other hand, if we were to turn around and rally, I think it is going to be more or less a “grind higher” than anything else.