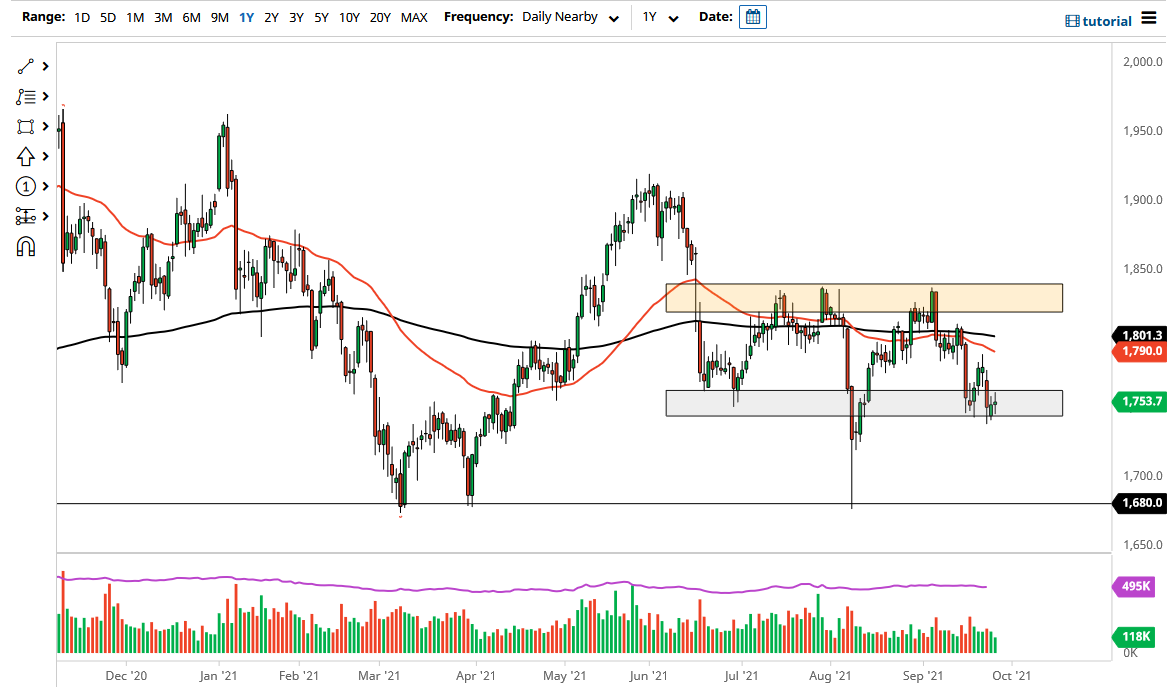

The gold markets have gone back and forth during the course of the trading session on Monday as traders came back to work from the weekend. Quite frankly, the markets are trying to figure out whether or not we are going to slice through support, or if we are going to turn around and show a bit of a bounce from here.

Remember, gold seems to be highly sensitive to the US dollar in the 10 year note yield, so you need to pay attention to both of those. If yields in America continue to rise, that will work against the value of gold given enough time. Gold is highly sensitive to interest rates in the United States, because it all comes down to the idea of whether or not you are going to be better served in a real rate of return by holding paper in the bond market, or if you need to pay for the storage for gold. The storage cost is something that retail traders typically do not pay attention to, because they do not necessarily take delivery of the commodity. However, the markets are getting close to the idea of whether they are going to go higher or lower, so I think that the next couple of candlesticks will make quite a big difference.

Breaking down to a fresh low opens up the possibility of a move down to the $1680 level, an area that has been massive support. In fact, if we break down below the lows of last week, I suspect that this will become an aggressive move to the downside. On the other hand, if we were to turn around and take out the top of the candlestick from Friday, it is likely that we go looking towards the 50 day EMA, perhaps followed by the 200 day EMA. In general, this market will continue to be very choppy and crazy, but at this point in time it is likely that we will get an impulsive candlestick that we can take advantage of. Any type of impulsive candlestick in one direction or the other opens up the possibility of a bigger move. Pay close attention to those yields as well, because of the huge negative correlation.