Gold futures closed lower yesterday despite weak ADP figures which boosted the safe-haven gold price to the $1,820 resistance level. Gold then settled around $1813 as of this writing. The price of the yellow metal is clinging to the psychological resistance of $1800.

Overall, investors agree with the US labor market data because it can help determine the pace and timing of the Fed's tapering of purchases of $80 billion in Treasuries and $40 billion in mortgage-backed securities, which have helped support U.S. financial markets during the worst of the pandemic.

However, the recovery from the pandemic, amid the spread of the coronavirus, has raised questions about the need for continued easy fiscal policy.

Private US companies created 374,000 new jobs in August, according to a new ADP survey. Economists expected an increase of 600,000. The July report showed 330,000 new jobs, which was revised down by 4,000 to 326,000 in the latest release. Commenting on the numbers, Nella Richardson, chief economist at ADP, said: “Our data, which represents all workers on corporate payrolls, has highlighted a downward shift in the labor market recovery. We have seen a drop in new hires, after significant job growth from the first half of the year. Service providers continue to drive growth, although the delta variant creates uncertainty for the sector.”

Mark Zandi, chief economist at Moody's Analytics, added that "Covid-19 appears to have affected the labor market recovery. Job growth remains strong, but it is far from the pace of recent months. Job growth remains closely linked to the course of the pandemic.”

In many ways, the ADP report, a large sample of the US labor market, is an opening to the most important economic data event of the week: the US jobs report for August. Tomorrow's report includes the non-farm payroll and unemployment rate, and will give investors their next major change in estimating when and how the Fed will begin to slow or scale back the rate of monthly asset purchases.

Recently, Fed Chair Jerome Powell indicated that the central bank will be watching employment data as it decides when to begin ending pandemic-era measures to add liquidity to the markets. Markets want a strong report and 720,000 new jobs are expected, but the employment numbers that are coming in very strong may actually raise concerns that the Fed will wane in its purchases sooner.

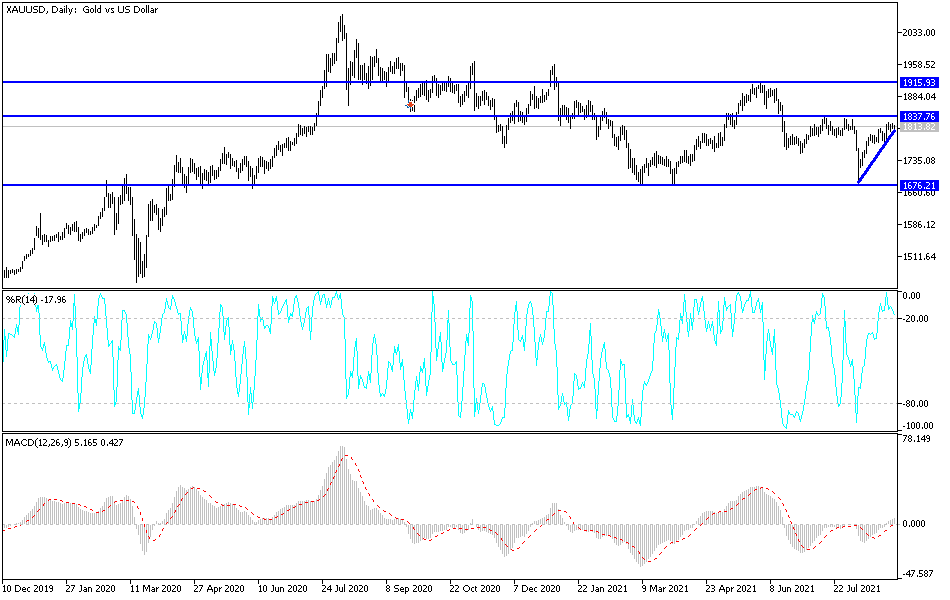

Technical analysis of gold

Stability above the psychological resistance of $1800 supports the dominance of the bulls and opens the metal up to buyers. Therefore, the resistance levels at $1819, $1827 and $1845 will remain the next targets for bulls. Gold will not give up its current bullish momentum without moving towards the $1,775 support level highlighted on the daily chart below. In general, caution should be exercised, as gold may stick to the current situation until the US jobs numbers are announced tomorrow.