After reaching the psychological resistance of $1800, which gives the bulls the impetus to move higher, gold's gains continued to the resistance level of $1823 before settling around $1813 as of this writing. The price of gold is awaiting the announcement of the US jobs numbers this week, which strongly affect the performance of the US dollar, and therefore the price of gold.

The price of gold may move in limited ranges as investors continue to wait cautiously for the US jobs report, which could provide clues about when the US Federal Reserve could begin to scale back its bond purchases and raise interest rates.

The US Consumer Confidence Index was at a six-month low, and on the other hand, some European Central Bank (ECB) officials are also beginning to consider whether to start tapering off assets, as the Eurozone CPI rose 3% year-on-year in August. Among the officials is European Central Bank Governing Council Member Robert Holzmann, who has suggested that asset tapering should be on the agenda at the Governing Council meeting scheduled for the following week.

In the Asia-Pacific region, the Chinese Caixin Manufacturing PMI was less than expected at 49.2, and according to the index data, any reading below 50 indicates a slowdown in growth in the sector. In Australia, GDP grew 9.6% year-on-year and 0.7% quarter-on-quarter.

South Korea has reported more than 2,000 new cases of the coronavirus, close to the daily record set last month, just a day after officials cautiously expressed hope that infections would slow. The 2,025 cases reported on Wednesday represented the 57th consecutive day of at least 1,000, and there are fears transmissions could worsen as the country approaches its biggest holiday of the year.

Officials are grappling with a slow vaccine rollout and eroding public vigilance despite stricter social distancing rules except for lockdowns in Seoul and other large population centers, where private social gatherings of three or more people have been banned after 6 p.m. There are fears that the virus could spread more quickly during this month's Chuseok holiday, the Korean version of Thanksgiving when millions of people usually travel across the country to meet with relatives.

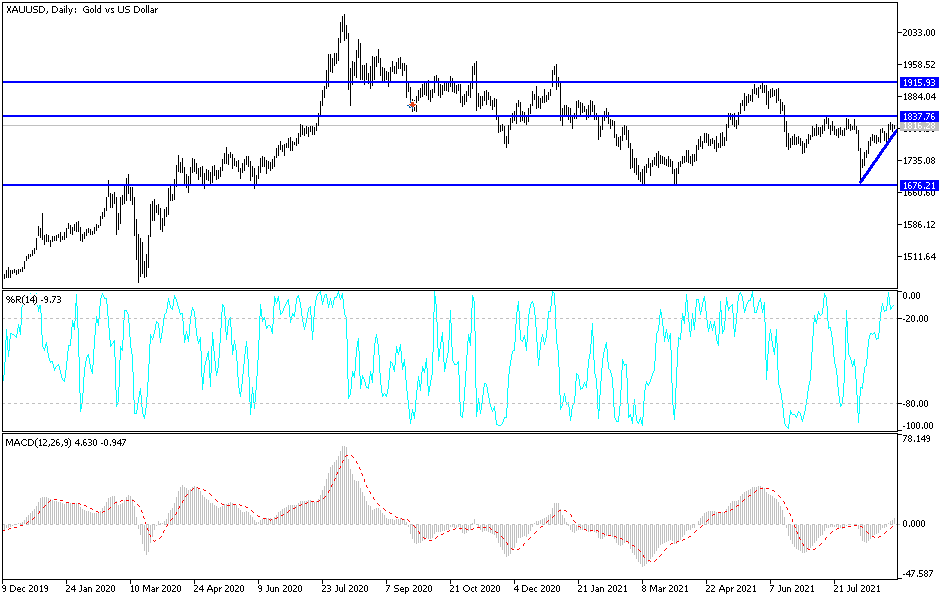

Gold technical analysis

So far, the stability of the gold price above the psychological resistance of $1800 opens up a move higher to test higher resistance levels, the most important of which are currently $1819, $1827 and $1845. Gold will not abandon the current path without moving towards the support level of $1775. I still prefer buying gold from every dip.