The price of gold showed a modest move to the upside during early trading this week amid falling US Treasury yields. The price of gold rose to the level of $1798 and settled amid limited trading around the level of $1794 as of this writing. The modest increase in gold prices came with a decline in US Treasury yields, after rising significantly in the previous session.

Gold prices also rose as the value of the US dollar slipped off its highs, and trading activity was somewhat subdued as investors look to release closely watched reports on US consumer prices, industrial production and retail sales in the coming days. This is in addition to data on consumption, industrial production and investment from China, which is scheduled for tomorrow, Wednesday, to reveal the extent of the damage caused by the outbreak of the delta variant.

Wednesday's data is likely to show that China's recovery remains erratic. Strong global demand led to record exports in August, but domestic consumers became cautious as lockdowns and fear kept many in their homes, meaning the industrial sector is expected to do better than retail sales. Consumption was hardest hit in August as the delta variant of COVID-19 spread across China, closing tourist sites and some cities during the summer holidays. But even before those cases, the recovery in consumption in China was not strong.

The German Economy Ministry said yesterday that the German economy is expected to record significant growth in the third quarter before returning to normal in the fourth. However, the ministry said in its monthly report that the increasing spread of novel coronavirus mutations and their impact on the infection process could cast a shadow over the outlook. According to official estimates, the Eurozone's largest economy recovered in the second quarter, with economic output rising 1.6 percent.

The government noted that the mechanical engineering and automobile industries, which had recently slowed down due to a shortage of semiconductors, were able to increase their production. Given this growth as well as the elevated system status, the outlook for the industrial economy remains cautiously optimistic, the ministry added.

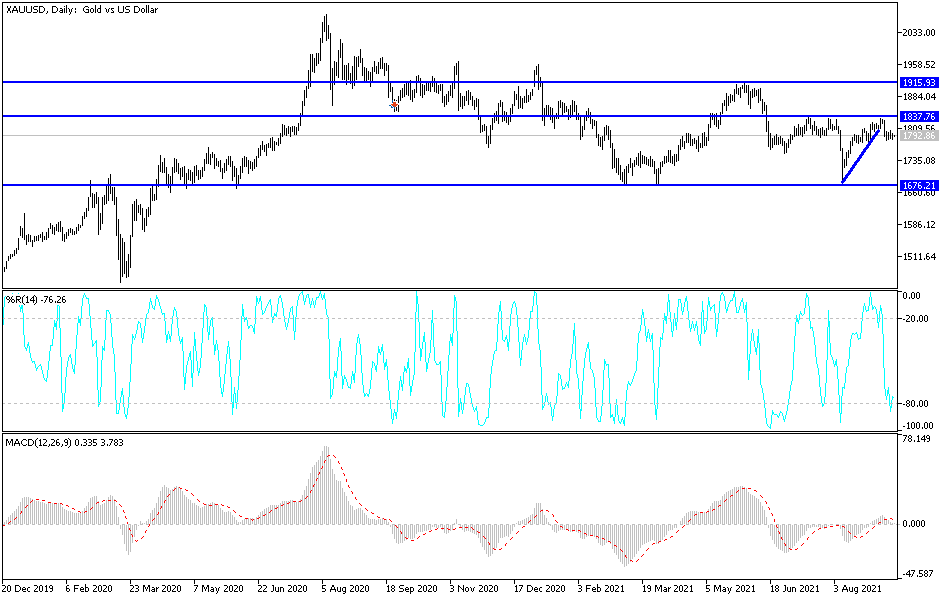

Gold technical analysis

Gold bulls need to move above the resistance of $1800 to increase buying, and in order to return to the vicinity of the bullish channel that was formed recently on the daily chart, whose gains stopped around the resistance level of $1834. The next targets for the bulls will be $1819, $1827 and $1845 dollars. On the downside, a move towards the support level of $1781 will motivate the bears to move towards the next support levels of $1772 and $1,760.

I still prefer buying gold from every dip, as the global concern about COVID variants may provide an opportunity for more restrictions on global economic activity, and global central banks are delaying their plans to tighten their monetary policy, which they hinted at for a while.