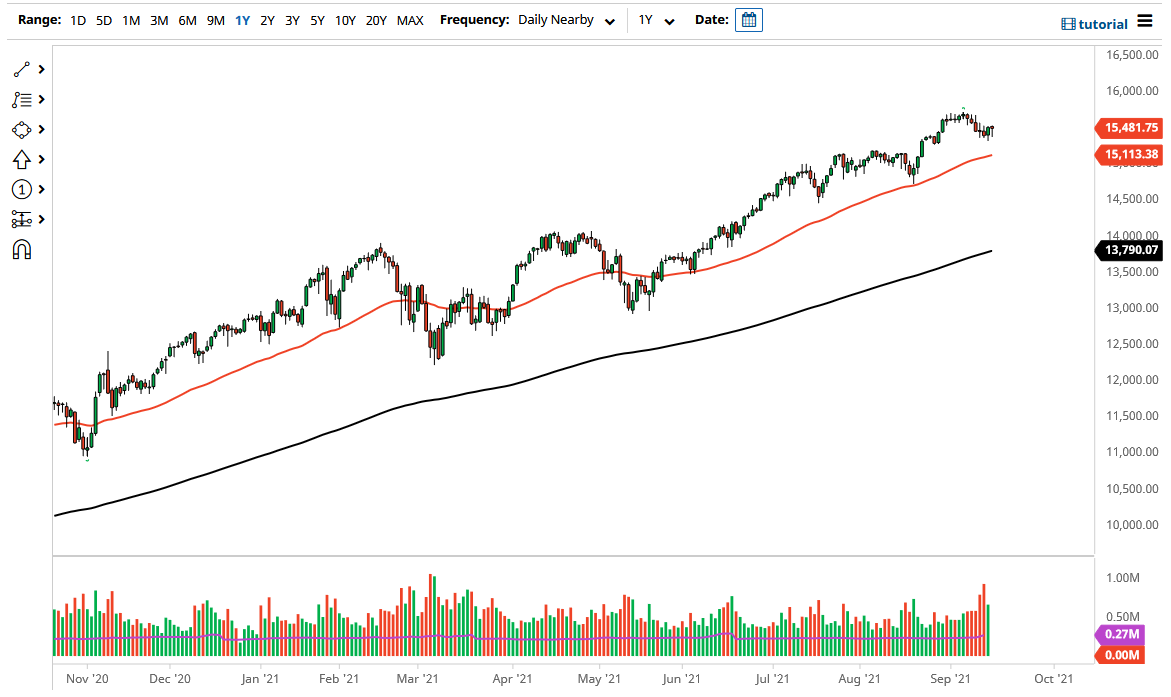

The NASDAQ 100 has fallen significantly during the course of the trading session on Thursday but then turned around to show signs of life again. The daily candlestick is a hammer, and that of course is a very bullish sign, and it looks like we could turn around and go much higher. The 15,500 level has been a significant level that people have been paying attention to, so at this point in time if we can clear that level then I think we go higher, reaching towards the 15,750 level.

Underneath, the 50 day EMA does offer a significant amount of support, as it is at the 15,100 level. The 15,000 level underneath there is also a large, round, psychologically significant figure that a lot of people will pay close attention to. I think that if we were to breach the 15,000 level, then the market probably goes much lower, therefore offer an opportunity to buy puts more than anything else. Looking at the overall attitude of this market, I think we continue to find plenty of buyers on dips in general, so I think what we are seeing is a bit of a “binary trade” in the sense that as long as we are above the 15,000 level, I would be a buyer in general.

The market will continue to move right along with interest rates and the US dollar, so keep that in mind as well. This is a market that is led by just a handful of stocks, so pay close attention to Tesla, Microsoft, and Apple. There are a few other ones but at the end of the day it is likely that we see this index move upon all of the “Wall Street darlings.” In general, this is a market that I think will continue to offer plenty of opportunities as it typically does, with the NASDAQ 100 being a rocket fuel Index overall. I believe that we are eventually going to go looking towards the 16,000 level, probably over the next couple of weeks. As long as nobody freaks out, we should continue to find plenty of value hunters on the occasional pullback. The overall look of this market is bullish, as we have been trading in a 45° channel, something that the market likes the doomed and there is a “slow and steady” grind higher.