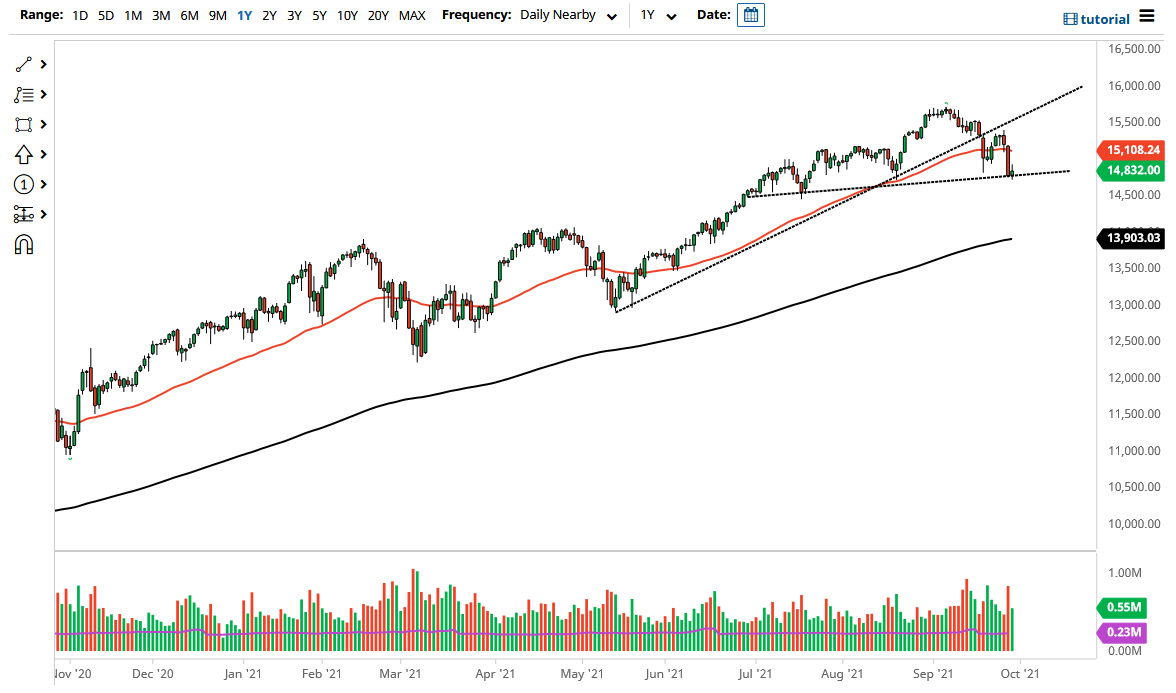

The NASDAQ 100 rallied initially on Wednesday but gave back early gains as the support line seems to be holding so far. That being said, if we break down below the lows of the trading session on Wednesday, the market is likely to go looking towards the 14,500 level, and then reach towards the 14,000 level. The 200-day EMA underneath continues to rise, and I think it offers a certain amount of support going forward. The market has been in a major uptrend for quite some time, so it would not be surprising at all to see some type of correction.

With that in mind, I think that a 10% correction makes sense, or at least down to the 200-day EMA. This is not to say we cannot turn around and rally, but it would not be until we wiped out the negative candlestick from the Tuesday session that I would consider buying. Yes, long term, this is a market that always seems to find buyers, but it is likely that we need to find a little bit more value in order to get involved.

If we were to break down below the 200-day EMA, that would obviously be a very negative sign; but even then, I would not short the market straightaway. I buy puts only when it comes to the US indices, due to the fact that the Federal Reserve interferes so often. The market is likely to see a lot of attention paid to it by the central bank if we drop quite a bit, but at this point it is likely safe is to simply buy a put in order to protect trading capital. The biggest fear is that if you were to short the market, the Federal Reserve would step in and before you know it, you could be down 500 points. With that in mind, in this market you can only lose what you pay. Furthermore, it also gives you the ability to leverage your position to the downside if it really takes off. I suspect that the next couple of weeks are going to be quite nasty to say the least.