The NASDAQ 100 fell significantly on Friday, but you should keep in mind that it is “quad witching”, meaning that several options are expiring at the same time. This tends to cause a lot of volatility, so it is likely that the selloff is probably partially due to that aspect.

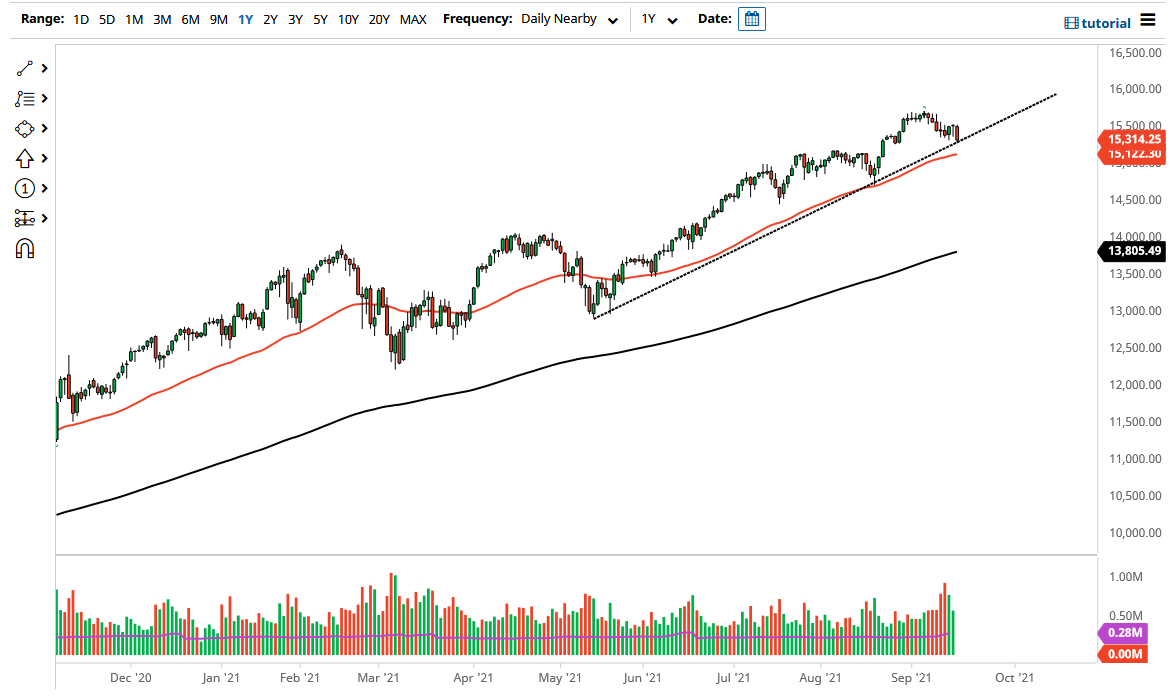

Having said that, when we look at the technical analysis, it is easy to see that there is a trendline that we are sitting right on top of, and then we have the 50-day EMA sitting underneath there as well. After that, the 15,000 level would be a major support level. I think there are plenty of reasons to believe that there are buyers underneath just waiting to get involved, based upon value.

Keep in mind that the NASDAQ 100 is heavily influenced by just a handful of stocks, so you have to keep that in mind. As long as Microsoft, Tesla, and others like that continue to rally, it is likely that the NASDAQ 100 will continue to go higher over the longer term. After all, it is only about seven stocks that move this market overall. This is a market that has been bullish for ages, so I think if we do break down from here, there will be some type of intervention from the Federal Reserve. The Federal Reserve will talk the market back up or get involved through the bond market one way or another.

That being said, if we were to break down below the 15,000 level, it is likely that I would be a buyer of puts, as it is the only safe way to short this market. However, I think it is more likely that we will go looking towards the 16,000 level before we see that happen. The market taking out the candlestick from the Friday session should send this market much higher, as it would be a major turnaround in attitude. This is a market that has looked a bit shaky over the last couple of days, but the trend has been long in the tooth, and it continues to go higher in general. I would build up a position slowly, because I think we still have plenty of volatility ahead of us.