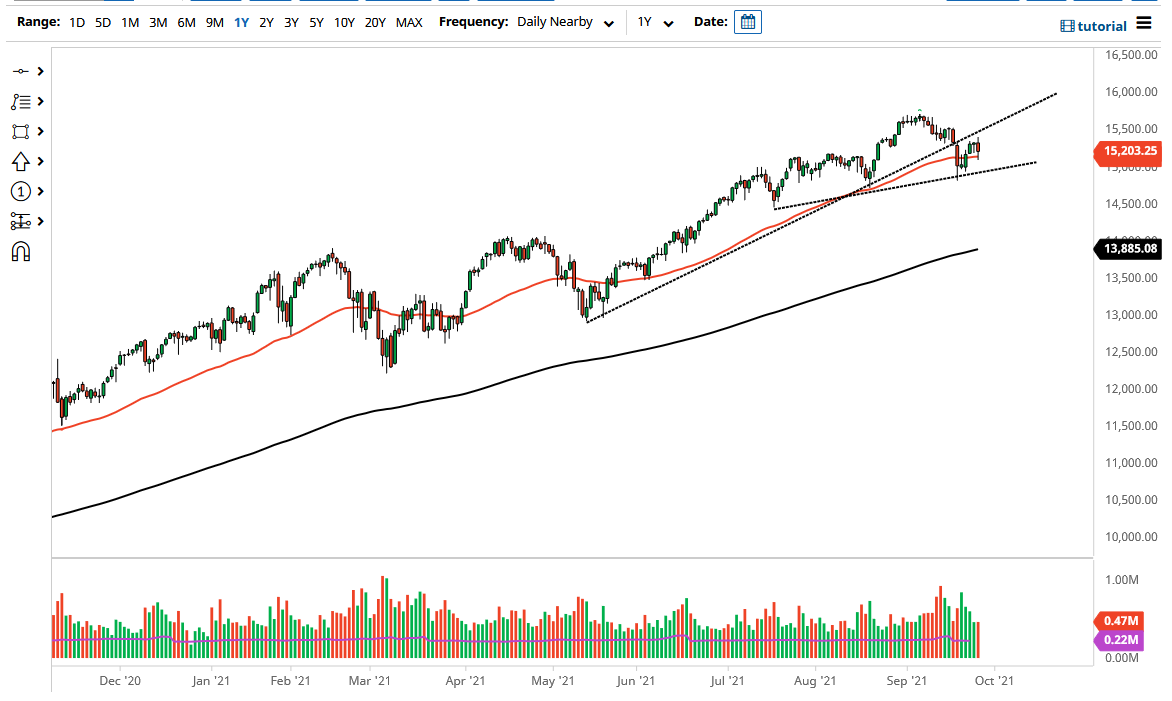

The NASDAQ 100 pulled back during the course of the trading session on Monday, to reach towards the 50 day EMA before turning around. That being said, the market looks as if it is finding a significant amount of support, as the 50 day EMA is an indicator that a lot of people are starting to pay close attention to overall. After all, it has been somewhat reliable, something that tends to be a bit of a self-fulfilling prophecy once everybody gets a hold of it.

Underneath there, we also have an uptrend line that comes into the picture so as long as we can stay above the highs of the previous week, I do think that the market goes higher over the longer term. Buying the dips continues to make a certain amount of sense, but the NASDAQ 100 is getting a bit hit due to the interest rates in America climbing, and that of course works against growth stocks in general. Nonetheless, this is a market that will find reasons to go higher over the longer term, if for no other reason than the traders on Wall Street are great at finding some type of narrative to push things to the upside.

If we do break down below last week’s highs, I am willing to buy puts for a potential move down to the 200 day EMA, but that is as bearish as I will get in this market. After all, the NASDAQ 100 is considered to be the “highflyers” when it comes to stocks in New York, and that will continue to be the case. In fact, it is almost impossible to short indices in the United States due to the fact that there has been so much in the way of market manipulation by the Federal Reserve. With that being the case, I think you simply wait for opportunities to get long, or at the very least all you do is buy puts to short the market. You need to preserve your trading capital, as any significant selloff will attract the attention of central bank officials and have them looking to get involved either verbally or through the bond market. In other words, the people in the Eccles building continue to have the back of Wall Street.