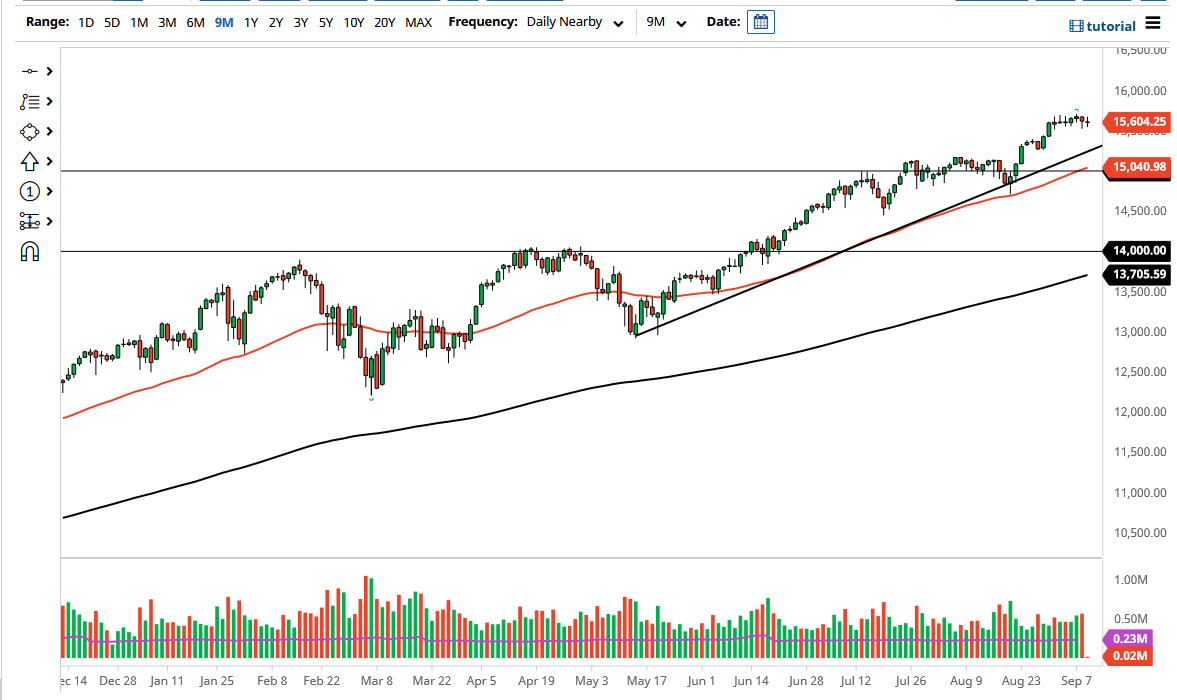

The NASDAQ 100 has gone back and forth during the course of the trading session on Thursday, as we continue to hesitate right around the 15,600 level. We have to pay attention to the fact that Friday is options expiration, and therefore we are going to see a lot of noisy behavior. Friday could be a very difficult trading session, and quite often these options expiration days tend to be all over the place. Because of this, if you think that it has been volatile recently, you have a lot to learn over the next 24 hours.

To the downside, the uptrend line continues to be massive support, and the 50 day EMA continues to reach towards that area. It should be noted that the 15,000 level underneath there would also attract a certain amount of attention, as it is a large, round, psychologically significant figure. Because of this, if we were to break down below there, I think we could see more selling, but at that point in time I would be a buyer of puts, as I simply do not short US indices. The main reason for this is that the Federal Reserve will get involved, either jawboning the entire situation or perhaps even jumping into the bond market in order to make noise. After all, although they do not explicitly admit to it, the number one job of the Federal Reserve is to protect Wall Street.

With this being the case, I think you are more than likely going to see a situation where we would have a “buy on the dips” type of mentality that we can get involved with. With that, I think that you probably step out of the way on Friday and see if you can find a little bit of value at lower levels. If we were to take out the recent highs just above, then it is a simple “buy-and-hold” type of scenario. I do believe that eventually the NASDAQ 100 goes higher, but if I get an opportunity to get into this market at a lower level, I'm more than willing to take advantage of that gift. We are in an uptrend, and that is the most important thing to keep in your mind as this market almost certainly will find one reason or another to go higher.