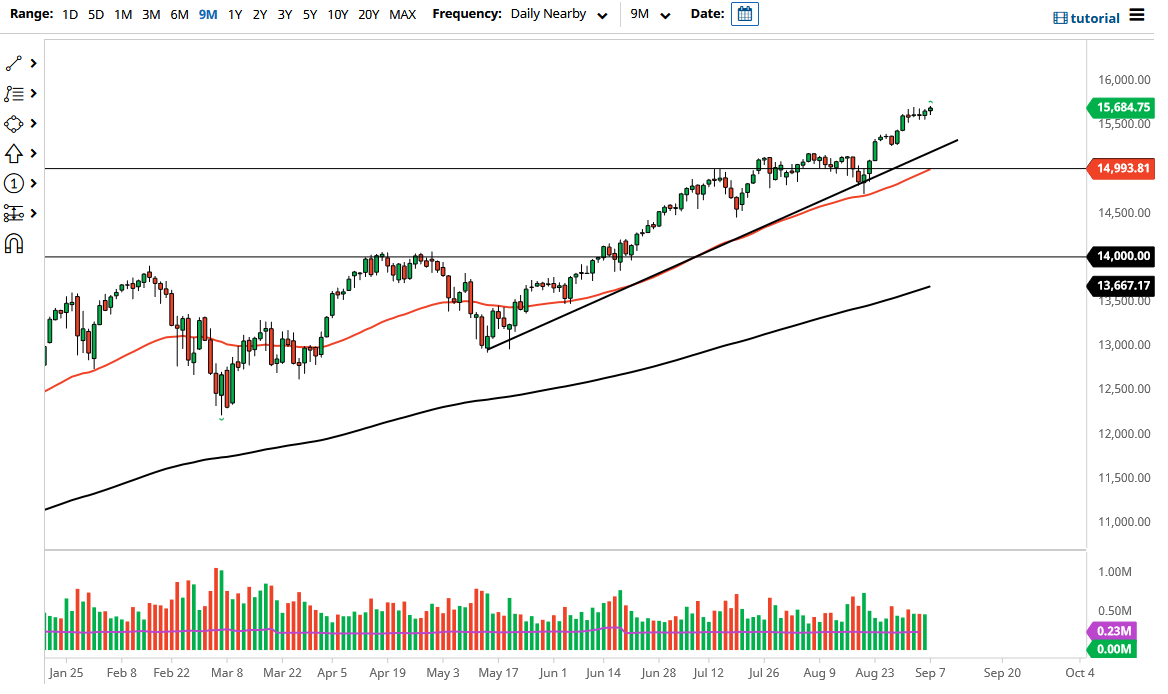

The NASDAQ 100 has rallied again during the trading session on Tuesday to show that it is by far the biggest leader of US stock markets in general. At this point, I anticipate that the market is going to go looking towards the 16,000 level, but it may take some time to get there. With that in mind, I think that you look at short-term pullbacks as buying opportunities, but quite frankly I could have said that almost every day for the last 13 years. There is no reason to think that the markets are going to suddenly change in the short term. With that being the case, I simply look at large figures as a potential area of support and resistance. In this case, I think the 15,500 level offers support.

Underneath there, we have the uptrend line and the 50 day EMA as well, both of which are going to attract a certain amount of buying pressure. In general, this is a market that will continue to see a lot of noisy behavior but over the longer term I would anticipate that more of the same is going to be seen. In the low rate interest environment, most investors will go looking towards “growth companies”, which are the leaders of the NASDAQ 100. Furthermore, we also have the Federal Reserve making sure nobody loses money, so that of course means that the market is not actually a free market.

The index is designed to go higher, so given enough time it will do that. If it was not designed to do so, the index would be equal weighted. It is not, nor will it ever be as it would look completely different. It is a product like anything else you buy, so keep that in mind. I also believe that we will eventually break above the 16,000 level, because quite frankly with all of the loose monetary policy, the Federal Reserve is forcing money into stocks because quite frankly there is nowhere else to put them. Bond yields being so low creates a bit of a feedback look, and that of course is a major driver with been going on. Granted, this will break sooner or later, but in the game will start all over again. The “boom bust cycle” is something that we are now going to live with forever.