The NASDAQ 100 rallied initially on Tuesday but gave back the gains to show a bit of hesitation. Ultimately, this is a market that looks as if it is ready to pull back a little bit, but it may just simply be overextended. Falling from here makes sense, but that does not necessarily mean that I would be selling the NASDAQ 100, because every time we do dip on Wall Street, buyers come back in as so much money is in the market right now based upon passive investing. In other words, these indices are built to go higher, not only due to the fact that they are market cap-weighted indices, but also when money goes into funds, they all buy something like SPY, or in this case, QQQ.

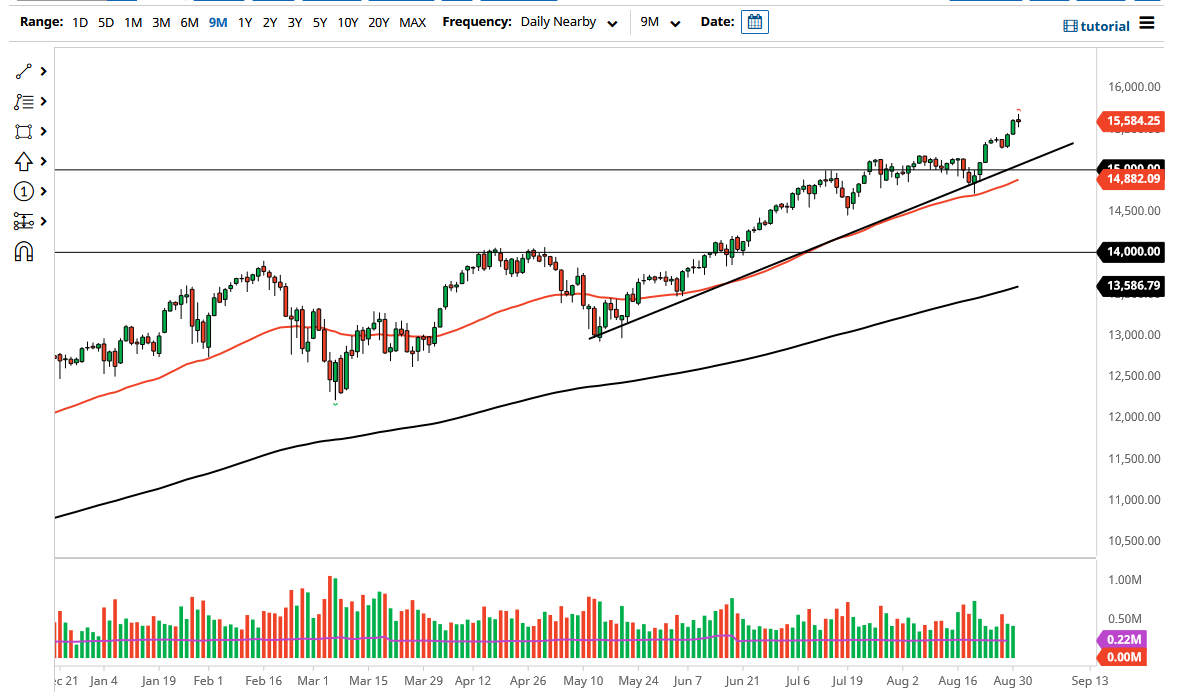

Any dip at this point will be a buying opportunity, especially if we get near the 15,250 level, and then the uptrend line underneath there. After that, we have the 50-day EMA and the 15,000 level both offering support also, so I would prefer to see some type of pullback that I can start buying into. As we get later into the week, we will start to focus on the non-farm payroll numbers, and that will take precedence over everything else. Nonetheless, we are in a nice uptrending channel, and it is likely that we will see more of the same behavior.

If we did break down below the 15,000 level, I might be convinced to buy puts, perhaps for a move down to the 14,500 level, and then possibly even the 14,000 level. At the 14,000 level, I would anticipate meeting up with the 200-day EMA which will be massive support as well. By the time we got down to the 14,000 level, one would think that the Federal Reserve would step in and save everybody on Wall Street as per usual. In other words, there is no other thing you can do but buy dips in this market, as that has been the case for the last 13 years. I do not see that changing in the next few days, although I could make an argument for a short-term pullback.