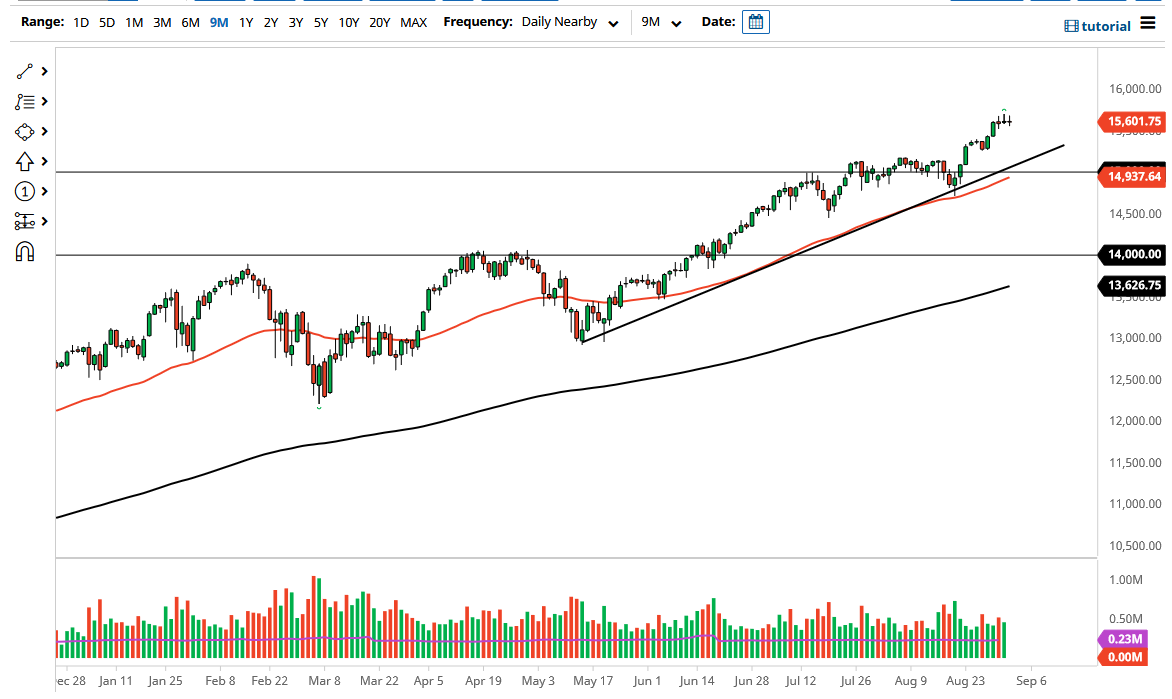

The NASDAQ 100 initially tried to rally during the trading session on Thursday but gave back the gains to form the third neutral or even exhaustive candlestick in a row. At this point in time, the market looks as if it is running out of steam, and therefore we could very well pull back towards the 15,000 level. The uptrend line underneath and the 50 day EMA walking across it has also been very supportive, so I think it is only a matter of time before the buyers return. With that in mind, I think that the jobs number my causing of volatility to offer value that you can take advantage of.

If the market were to break out above the top of the shooting star from the previous session on Thursday, then it could open up a relatively big move, perhaps sending the NASDAQ 100 towards the 16,000 level. That is a large, round, psychologically significant figure, and that of course is something worth paying attention to. The markets do tend to pay close attention to these big figures, so do not be surprised at all to see that targeted and cause issues.

That being said, we are a little overdone and a pullback is probably a good thing. It is very possible that if we see interest rates spike in the United States, the NASDAQ 100 could end up offering a reason for the NASDAQ 100 to break down a bit. Nonetheless, I just do not see this market breaking down below that uptrend line, but if we do clear the 15,000 level, then it is possible that we could break down a bit and it might offer an opportunity for me to start buying puts. After all, the markets are highly influenced by the Federal Reserve, so therefore if we do break down a bit it is likely that the Fed will do something to jawbone the markets back to the upside, as we continue to see them rude for Wall Street like they have for the last 13 years. There is no situation right now that I could consider shorting this market outright, so little bit of patience to pick up value on a pullback probably makes the most amount of sense currently. With that, I remain bullish but recognize that we may have to take a break.