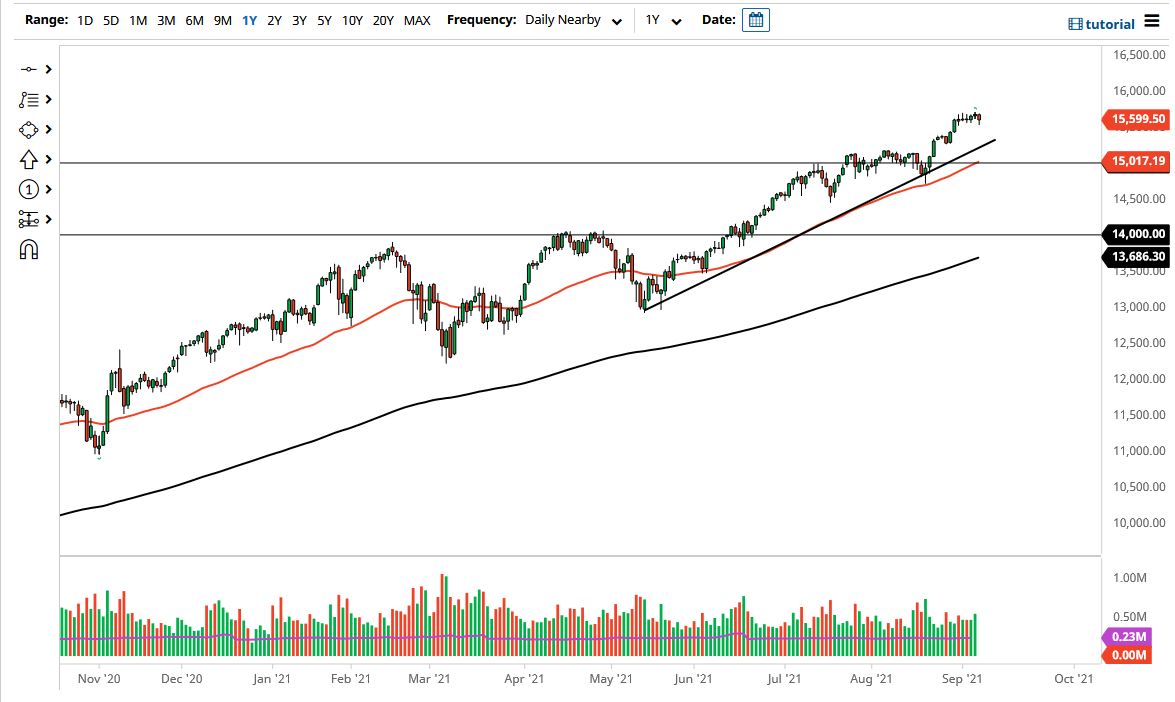

The NASDAQ 100 pulled back a bit on Wednesday as we continue to see nauseating volatility. The NASDAQ 100 pulled back towards the 15,600 level, and then turned around to show a little bit of life towards the end of the day. Nonetheless, this is a market that has chopped around without any real direction over the last six or seven days and may be either a little overbought or simply grinding away in order to make the next move.

To the downside, we have the uptrend line that should keep the market somewhat afloat, right along with the 15,500 level. Underneath there, we have the 15,000 level followed by the 50-day EMA which is hanging right around the same level, so all of that should offer enough support to get this market higher over the longer term. Beyond that, do not forget that the Federal Reserve will do whatever they can to keep Wall Street profitable, as the stock market is a measure of how their job is being done (although they will vehemently deny this.)

If we do break down through all of that noise underneath, then I might be a buyer of puts, but that is about as bearish as you can get in a market that is so heavily pushed around by the central bank. With that being the case, I think that it is probably only a matter of time before we see the central bank do something to keep everything afloat via jawboning or something in the bond market. Beyond that, if bond yields stay relatively low, then that pushes money into the stock market, specifically “growth stocks.” Those are the same stocks that drive the NASDAQ 100 higher, because the weighting of the NASDAQ 100 is heavily influenced by just about eight or nine stocks, so it really should be called the “NASDAQ 10.”

With this being said, pay attention to Facebook, Alphabet, Tesla, and the like. The market will continue to see a lot of noisy behavior, but ultimately Wall Street will come back in and convince itself that the Federal Reserve will keep it afloat. With this, look for some type of pullback that offers value, because we have not had a serious pullback in well over year.