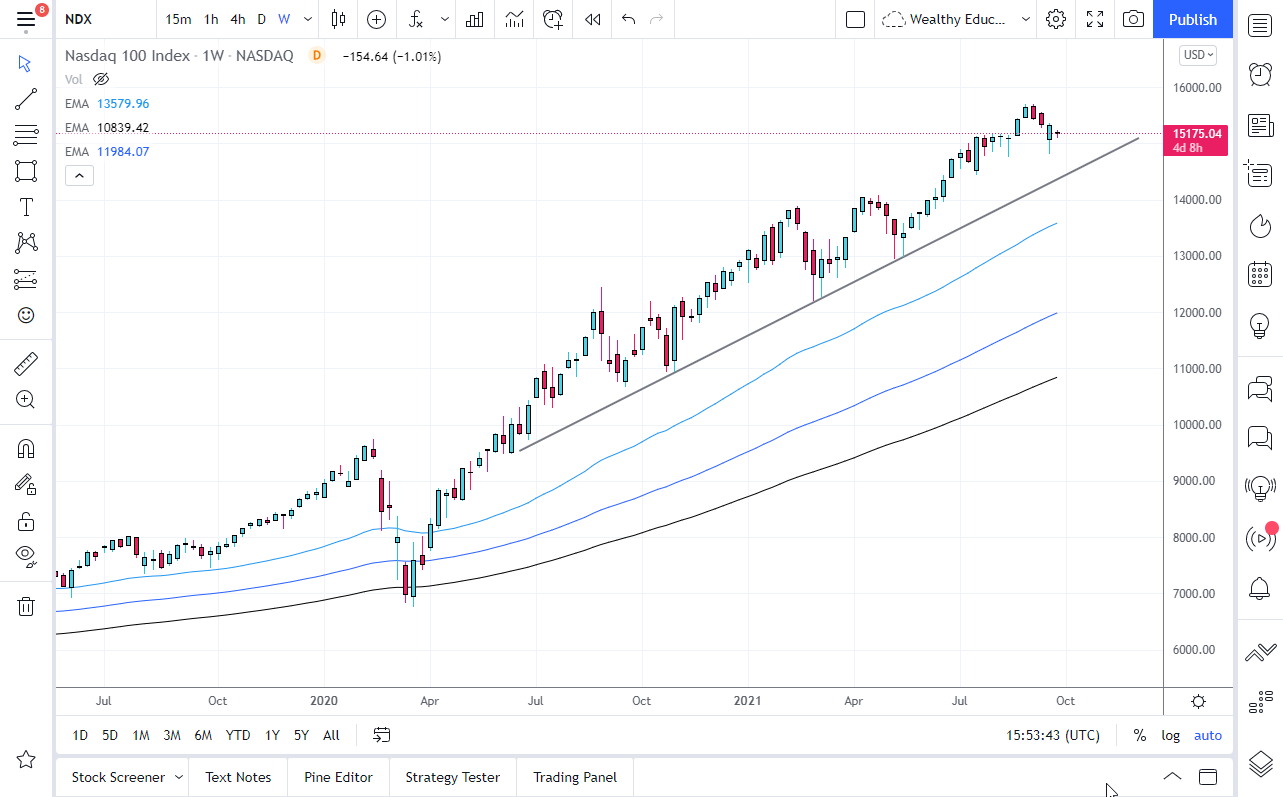

The NASDAQ 100 has been in an uptrend for what seems like ages, and of course the overall attitude has always been one of “buy on the dips”, and I think that might continue to be the case. That being said, we are very sensitive to the US dollar and of course more importantly, the US yields. The 10 year yield has been rising for a while, which tends to work against the value of the NASDAQ 100 as it is driven by just a handful of major stocks, meaning that you need to pay attention to the bigger “growth stocks.”

As long as Tesla, Microsoft, Alphabet, and others like that rally, the NASDAQ 100 is certainly going to be driven higher. The market tends to figure out more of the same behavior going forward, but we may have a little bit of a pullback ahead of us. As far as shorting this market is concerned, it is suicide from a financial standpoint. The uptrend line underneath could offer a significant amount of support, and the fact that the one, two, and three year moving averages are all rising and spread out suggests that we are most certainly in a strong uptrend.

I believe that most of the month of October is going to be about finding value in the NASDAQ 100, because quite frankly it is difficult to imagine a scenario where stocks suddenly fall apart. After all, even though the Federal Reserve is talking about tapering, the reality is that rising rates are probably going to do so much damage to the market, as the fact that even though rates are rising, they are well below the inflation rate, meaning that traders will continue to jump into stocks regardless. That being said, if we do break down below this uptrend line, I suspect that somewhere near the 14,000 level we will have value hunters jumping into the market. After that, the 13,000 level is likely to be supportive as well. All things being equal, this is a market that I think will continue to go much higher, so I just do not see how this changes for the next month. We might have a week or two of weakness, but the value hunters will be around before you know it. The 16,000 level could very well be targeted by the end of the year.