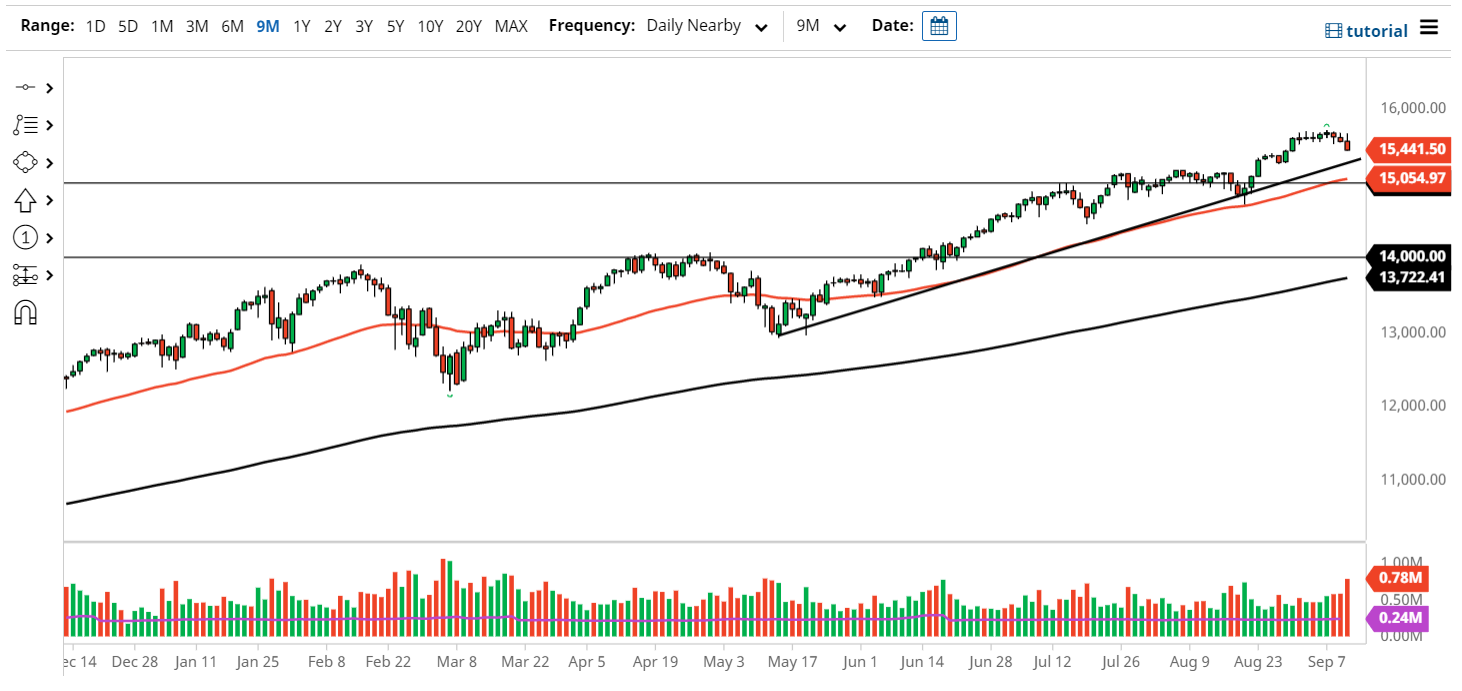

The NASDAQ 100 initially tried to rally on Friday but gave back gains to form a very negative candlestick. Beyond that, the market has also closed at the absolute lows, suggesting that perhaps we have further to go to the downside. Regardless, there are a couple of areas underneath that I'm paying close attention to for signs of support, in order to keep the overall trend intact.

The first thing that I am watching is the uptrend line that is just below current pricing. Underneath there, the 50 moving average crossing above the 15,000 level also offers a lot of support. That is a large, round, psychologically significant figure that a lot of people will pay close attention to, and one of the more popular options strike price levels. I'm fairly certain that there are quite a few buyers in that region due to the psychology of the area.

Having said that, if we were to break below the 15,000 level, I think we could drop as low as 14,000 as the 200-day moving average is approaching that level. Furthermore, it would be a nice pullback in what has been a major move higher, in a relentless uptrend for all US indices. The market has been moving at a roughly 45 degree angle, so it's not as it has been out of control or anything, it's just been more or less relentless.

The NASDAQ 100 loves low interest rates, because the handful of companies that move this index are all considered to be growth companies. The usual handful of names will drive this market higher or lower, so pay attention to what interest rates are doing in the United States, by watching the 10-year yield. I do anticipate a little bit more of a pullback, but I also think that it will end up being a nice buying opportunity as everybody knows the Federal Reserve will do what it takes to keep Wall Street happy. In that scenario, you are either on the sidelines or buying. Right now, I would be on the sidelines, but certainly would be willing to buy at lower levels once we get a little bit of clarity.