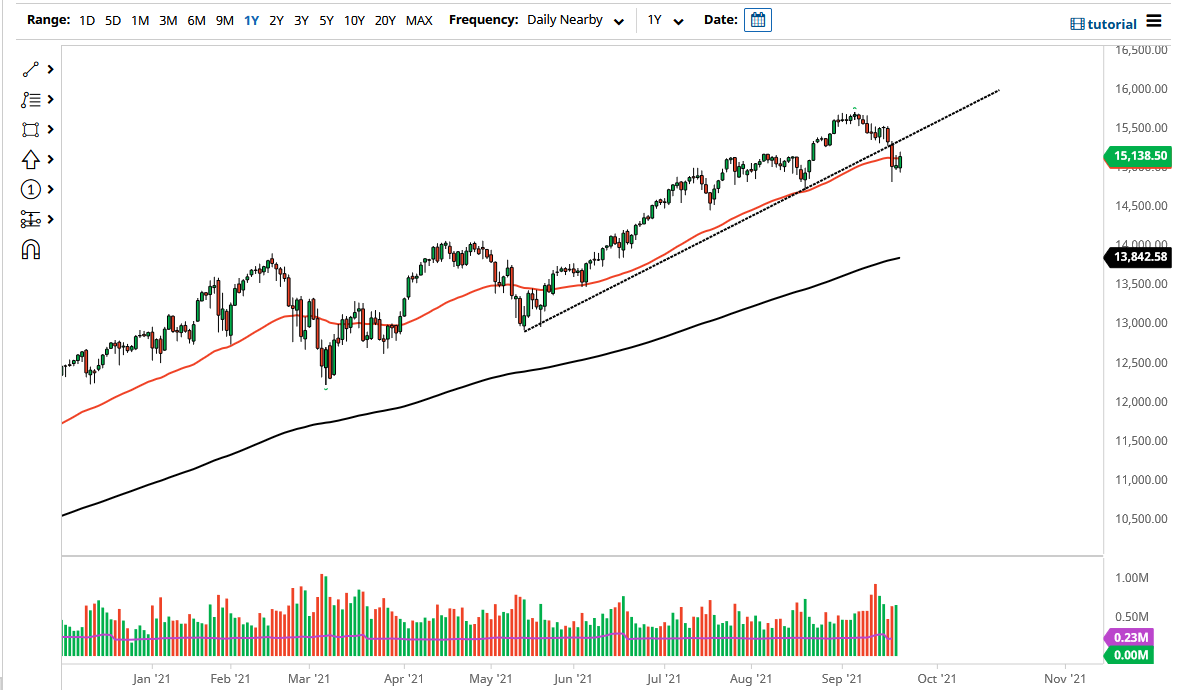

The NASDAQ 100 rallied a bit on Wednesday to break above the 50-day EMA. The 50-day EMA being broken to the upside is a very bullish sign, especially if we can take out the nasty candlestick on Monday. Taking that would be a very bullish sign and could send this market much higher. The previous uptrend line is there as well, and that could offer a bit of resistance. Clearing that would be a hugely bullish sign.

With the FOMC meeting, traders on Wall Street will be looking for some type of directionality as the markets continue to focus on monetary flows more than anything along the lines of fundamentals. On the other hand, if we were to take out the bottom of the candlestick from the Monday session, then I would be a buyer of puts. We could go as low as 14,000 at that point, with the 200-day EMA reaching towards that area.

The 50-day EMA is going somewhat sideways, but it looks as if the market is trying to stabilize. At this point, I think it is only a matter of time before we see buyers come back in, but the question now is whether or not it will happen right away, or if we are simply going to grind sideways in order to stabilize everything. Remember that the NASDAQ is highly driven by technology stocks, and of course low interest rates. As long as interest rates in the United States stay low, that tends to help the NASDAQ as well, because the technology stocks tend to be the biggest growth stocks.

I do expect a lot of volatility, but at the end of the day the market has pulled back quite a bit, so it does make sense that value hunters will come back in. Furthermore, you simply cannot short stock indices in America, as that has been nothing short of reckless for the last 13 years or so. This is a market that I think continues to see a lot of noisy behavior, but we should see momentum shift to the upside sooner rather than later.