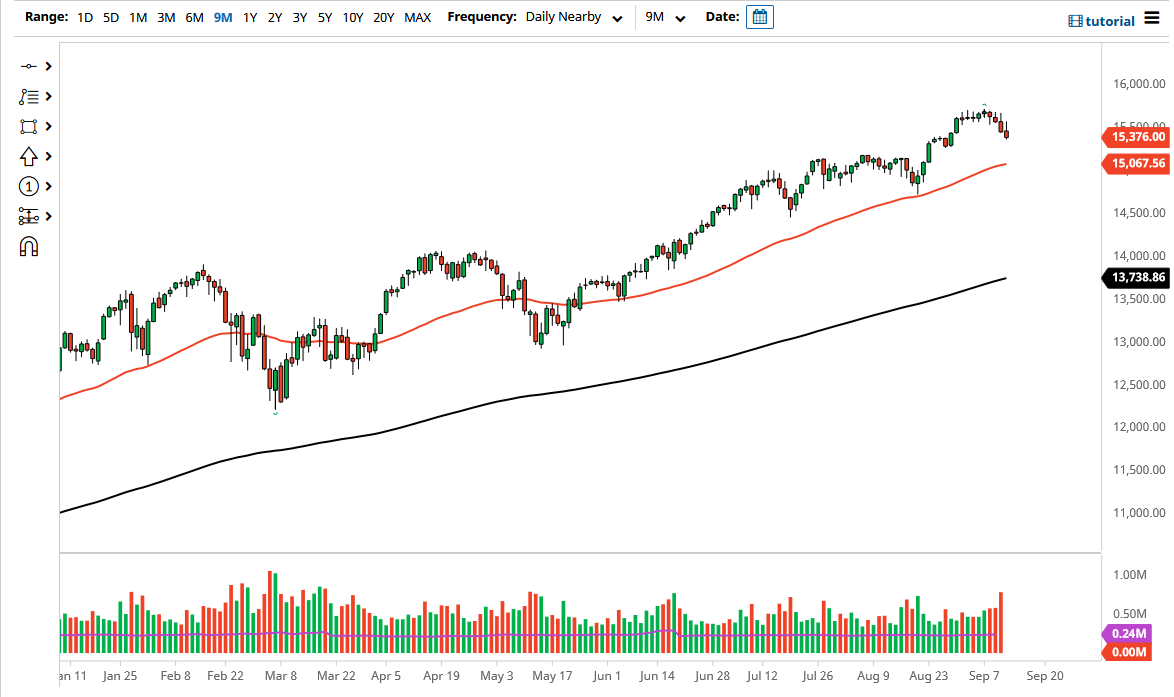

The NASDAQ 100 rallied significantly on Monday, but as you can see, gave up early gains to form yet another ugly candlestick. It looks as if we are going to continue to see downside pressure, perhaps opening up the possibility of a move to much lower levels. That being said, the 50-day EMA underneath is going to offer a certain amount of support, as it is an indicator that a lot of people have paid close attention to. Furthermore, we have an uptrend line that comes into the picture, so I think it is probably only a matter of time before we go higher.

I am looking to see whether or not we get some type of stable candlestick over the next session or two, and then I will get aggressive. Until then, I need to sit on the sidelines and wait to see whether or not we have a supportive candlestick that I can get behind. This is a situation in which we will see the market rolling over, as every time we have tried to go higher the sellers have come back in to push lower. Nonetheless, this is not a market that I would sell, mainly due to the fact that the Federal Reserve continues its loose monetary policy, so I think there is no real way to fight that.

If we do break down below the 50-day EMA, then it is possible that I might be a buyer of puts, but that is about as aggressive as I get to the downside when it comes to this market, as it is only a matter of time before we see the Fed get involved either through jawboning, or some type of bond purchasing. The markets continue to look a bit threatened at this point, but when you look at the totality of the trend, this has been yet another blip on the radar, not some type of major breakdown. Underneath, the 15,000 level would be something that a lot of people pay close attention to. That big figure will cause a lot of headlines, but I think it will also cause a lot of buying, perhaps due to the big figure or just simply the fact that there have to be quite a bit of options barriers there as well.