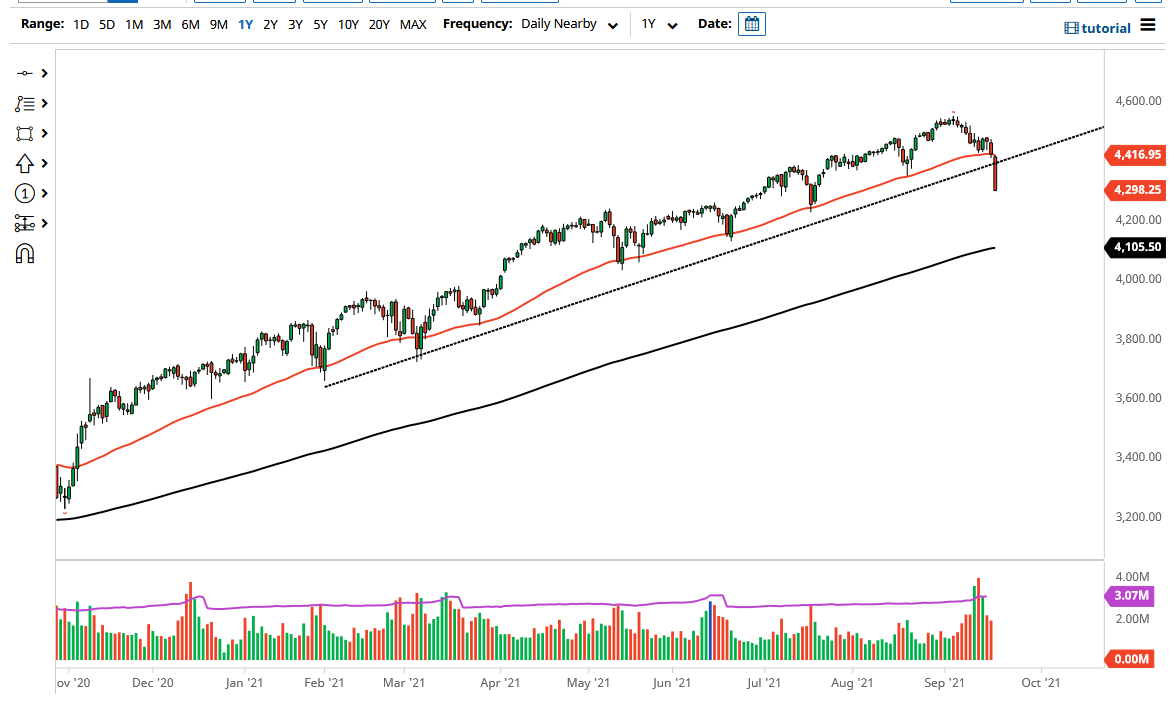

Chinese credit worries continue to be a major issue for markets, and it looks as if the S&P 500 has finally woken up to the reality that this could be a major contagion event. The market has broken significantly below the 50 day EMA and the previous uptrend line, but more importantly has closed at the very bottom of the range. That in and of itself suggests that we have quite a bit of negativity ahead of us, perhaps even some type of short-term meltdown. Nonetheless, I have no interest whatsoever in trying to get long of this market, nor do I want to short it.

At this point, I am starting to buy puts, because I believe that this market is going to fall. However, the Federal Reserve will step in and do something to protect Wall Street and its interests, because that is what it is there for. With that being the case, the market is likely to continue seeing a lot of noisy behavior, so that is why I am not one to short it right away. The market will almost certainly see a lot of support near the 4100 level, which is where the 200 day EMA sits. With this being the case, the market is likely to see a lot of value hunters in that area, because quite frankly it always seems to find value hunters.

If we turn around and take out the 50 day EMA to the upside, then it is likely that the market goes looking towards the 4500 level, possibly even the highs again. The market has sliced through the uptrend line, but at this point in time I still do not see a reason to short as that has been a losing game for well over 13 years. As long as that is going to be the case, then it is likely that cautious, or perhaps just wait a while until we get a supportive candlestick that suggests you should be getting long of the market again. Until then, you are either buyer of puts, or you are sitting on the sidelines as it is easier to simply wait for a trade that you can hang onto for multiple weeks, which is exactly what buying is when it comes to this market.