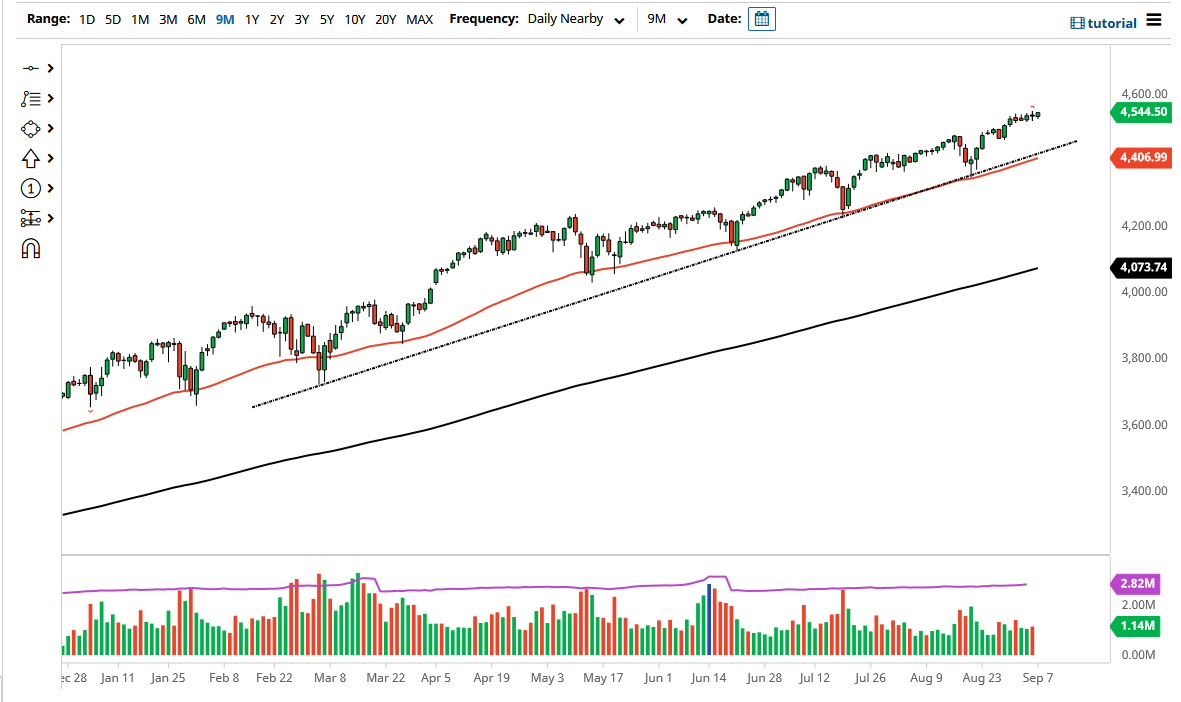

The S&P 500 has rallied a bit during the course of the trading session on Monday, despite the fact that the underlying index was closed due to the Labor Day holiday in the United States. That being said, the market has been in an uptrend for ages, so really at this point unless you have been living in a cave for the last 13 years, you know that eventually the market goes higher. This does not mean that you jump into the market and ignore what goes on, just that you are not looking for short opportunities.

If we were to break down below the uptrend line and the 50 day EMA, then it is likely that the market breaks down. At that time, I would be looking to buy puts, not short the market because quite frankly Jerome Powell and company will not allow Wall Street to lose too much money. If you have ever wondered about a conflict of interest, it has been recently revealed that Jerome Powell has over 60% of its net worth in US stocks. No conflict of interests there.

Regardless of whether or not it has anything to do with his personal wealth, the Federal Reserve clearly looks at the stock market has the most important barometer for its job, perhaps right along with jobs numbers. Because of this, they will do everything they can to keep both of them looking good, and we have seen multiple instances over the last 13 years that the Federal Reserve has either jawbone the market to the upside, and then after that jump into the bond market or something to that effect. In other words, the game is rigged, so you need to play it the way it is designed. In fact, when you look at stock indices, especially in the United States, the market favors the top 10 stocks or so, so they are designed to go higher over the longer term. In other words, they are products that are made for buying, and not necessarily selling. This is not to say that we cannot break down, just that you should ignore selloffs. At this point, I look at the uptrend line and the 50 day EMA as a bit of a “floor the market.” To the upside I anticipate that we go looking towards 4600, followed by 4700.