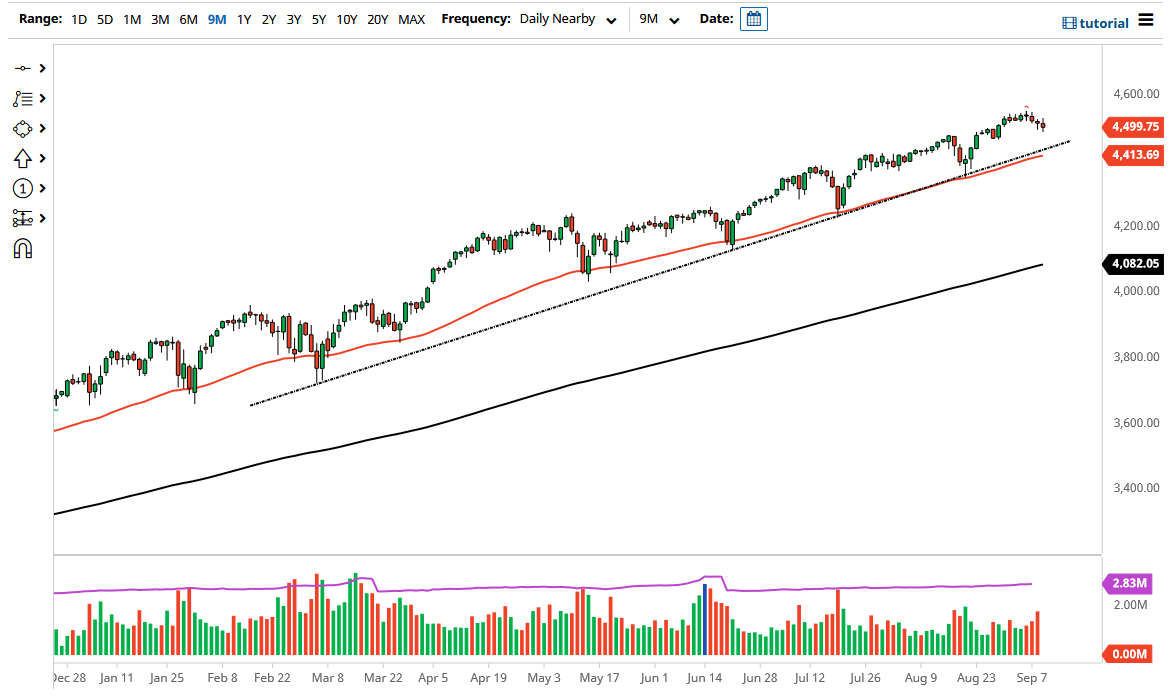

The S&P 500 has fallen just a bit during the course of the trading session, as it looks like we are rolling over just a bit. This is a market that has desperately needed a pullback for quite some time, and now that we are seriously testing the 4500 level, if we break down below the bottom of the candlestick for the trading session on Thursday, then we could go looking towards the uptrend line.

The uptrend line also features the 50 day EMA, so I think both of those could cause a little bit of support, and I think at that point in time if we see some type of turnaround and supportive candlestick would be a reason to get long again. After all, we have been in an uptrend for what seems like a lifetime now, and this is a market that is obviously followed very closely by the rest of the world. The Federal Reserve continues to do everything it can to keep the market afloat, so that comes into the picture as well.

All that being said, if we were to turn around a break down below the 50 day EMA and the uptrend line, then it is possible that we could go looking towards the 4200 level. The market breaking down below the 50 day EMA opens up the possibility of buying puts, but I would not be shorting this market because again, the Federal Reserve will save Wall Street if it comes down to it. On the other hand, if we were to turn around a break above the recent highs, then I think the market goes looking towards the 4600 level.

Keep in mind that the Friday session is also options expiration day, so it is very likely that we would see a lot of volatility and therefore I think it is only a matter of time before we bounce back and forth and test multiple short-term support and resistance levels. All things been equal, I think that the market is probably one you need to wait until Monday to put a trade on, but regardless, it is going to be to the upside unless of course a by those puts. Because of this, it is only a matter of time before we go higher, as we did over the last several months.