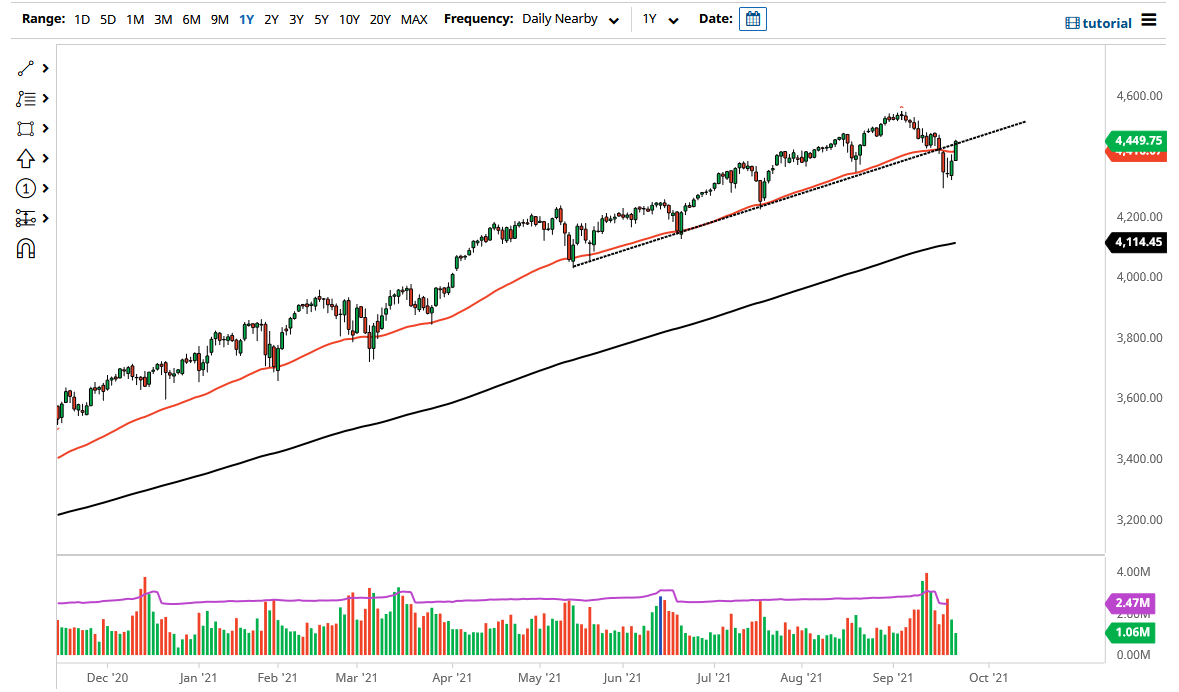

The S&P 500 has rallied significantly during the course of the trading session on Thursday as we continue to see a lot of bullish pressure. The fact that we recapture the 50 day EMA is obviously a very bullish sign, as we are also above the previous trendline. This of course will be something that attracts a lot of attention as well, so if we can clear the 4475 handle, that would more than likely send this market much higher. I think at that point in time we are likely to go much higher if that does in fact happen.

On the other hand, if the market were to turn around a break down below the lows of the Monday session, it is very likely that the market could go looking towards the 4200 level. That is where the 200 day EMA is racing towards at the moment, so therefore it is likely that we would see a flush lower, but then eventually the buyers would more than likely come back into the picture based upon value hunting. The market is truly trying to pick up its feet, but it certainly sees a lot of headlines out there that could cause issues. With this being the case, I think it is only a matter of time before the market has to make a bigger move, perhaps to the upside but it obviously has work to do before we get clarity.

There are a lot of noisy factors out there right now, but ultimately this is a market that eventually finds reasons to go higher, if for no other reason than liquidity measures continue to push traders into the stock market. After all, this has been a situation where it has been all about going out on the risk curve for some time, and I just do not see that changing. Yes, there are a lot of concerns out there and quite frankly we need to see some type of significant pullback, but longer-term it continues to be a scenario where value hunting comes back into the picture regardless. Quite frankly, it is difficult to imagine a scenario where I would be short of this market other than buying a put. Longer-term, I think we still go looking towards the 4600 level.