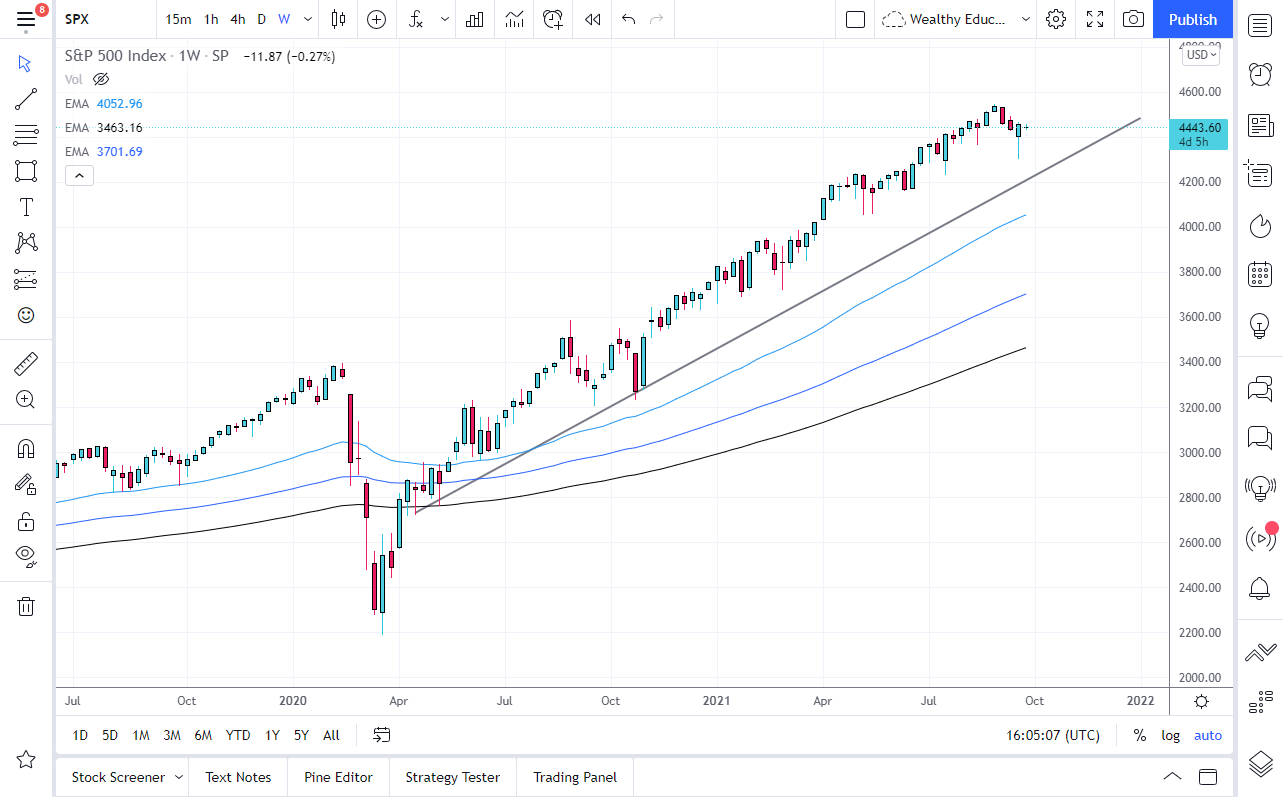

The S&P 500 has been drifting a little bit lower over the last several weeks, as September has been a little bit difficult. That being said though, the market is likely to see a lot of buyers on dips going forward, as every time we pull back, it seems like there is always some type of narrative to push this market even higher. Underneath, there is a significant trend line that comes back into the picture on a little bit of a dip, that we have been paying attention to. Furthermore, the market has generally been a “buy on the dips” type of situation, and as long as there is some type of narrative on Wall Street to listen to, it will all be bullish. After all, the traders on Wall Street know that the Federal Reserve has their back.

The market reached as low as 4300 during the month of September, and therefore we have a little bit of a short-term floor the market, but the 4200 level underneath there I think is even more crucial. A bounce from that level will more than likely turn around the market to go looking towards the 4500 level. Quite frankly, the S&P 500 is likely to see value hunters coming out to take advantage of any opportunity.

There are a lot of concerns about global growth, but at this point in time it seems to be very unlikely that last for anything more than 10%. After all, the Federal Reserve has gotten involved in the market one way or another through either jawboning or bond purchases. In other words, they are there to protect Wall Street, and recently we have seen a lot of conflicts of interest when it comes to the Federal Reserve governors and the stock market. With this, it is hard to bet against the idea of the stock market going higher, and I do think that one way or another we will get a narrative to push markets higher. After all, that is what we have seen for the last 13 years, and I think it is going to change suddenly is probably a bit of a stretch. It seems simplistic, but you are either buying this market, or sitting on the sidelines. If we do break down below the 4200 level, I might be a buyer of puts, but that is about as bearish as I get.