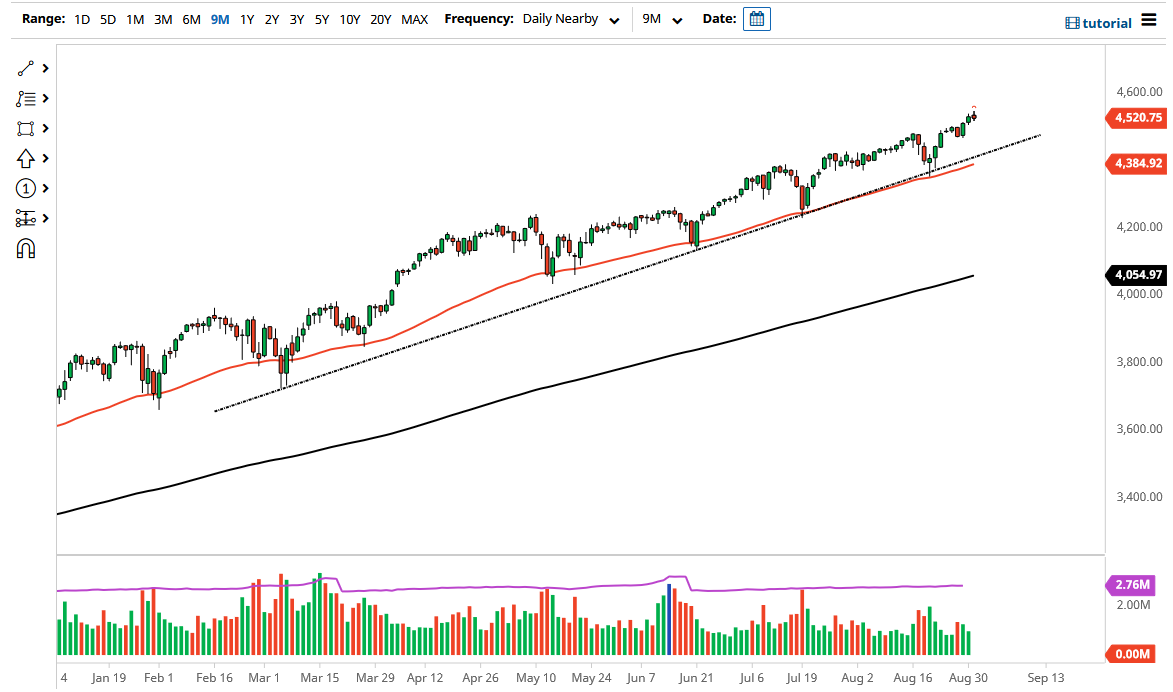

The S&P 500 initially tried to rally on Tuesday but turned around to show signs of hesitation. The S&P 500 continues to go higher over the longer term, but it looks like we may take a little bit of a breather this week, as it ends up being the one of the dullest times of the year, with a lot of the traders away on holiday. The volatility will shrink even further as we go into this week, as the non-farm payroll announcement comes out on Friday.

In the short term, we are probably due for a little bit of a dip, but I would anticipate somewhere near the 4450 level the value hunters will come back into this market. If we break down below that level, then it is likely we will go looking towards the uptrend line underneath there, as well as the 50-day EMA in that general vicinity. In other words, that is the “hard floor in the market” that we have at the moment. If we break down below that level, then it is likely that we could break down rather significantly, prompting me to start buying puts, but I would have no interest whatsoever in shorting this market because Jerome Powell will eventually save Wall Street.

To the upside, if we do continue to grind higher, it is likely that we will go looking towards the 4600 level, as the S&P 500 tends to move in 200-point increments. Furthermore, we are in an uptrend anyway, so I do not have any interest in trying to short this market based upon that alone. The shape of the candlestick does suggest a little bit of a pullback, but I think a short-term one at best. Once we get into the middle of September, there will be much more money in the market, and I think you will be able to trust the moves a little bit more at that point. Regardless, this remains a “buy on the dips” type of market, and as long as you do not overleverage yourself, buyers will come sooner or later to rescue a long position. Granted, there are the occasional issues that the market has, but let us face it here: a drop of 10% feels like the world is ending, and gets a lot of Fed speakers jawboning.