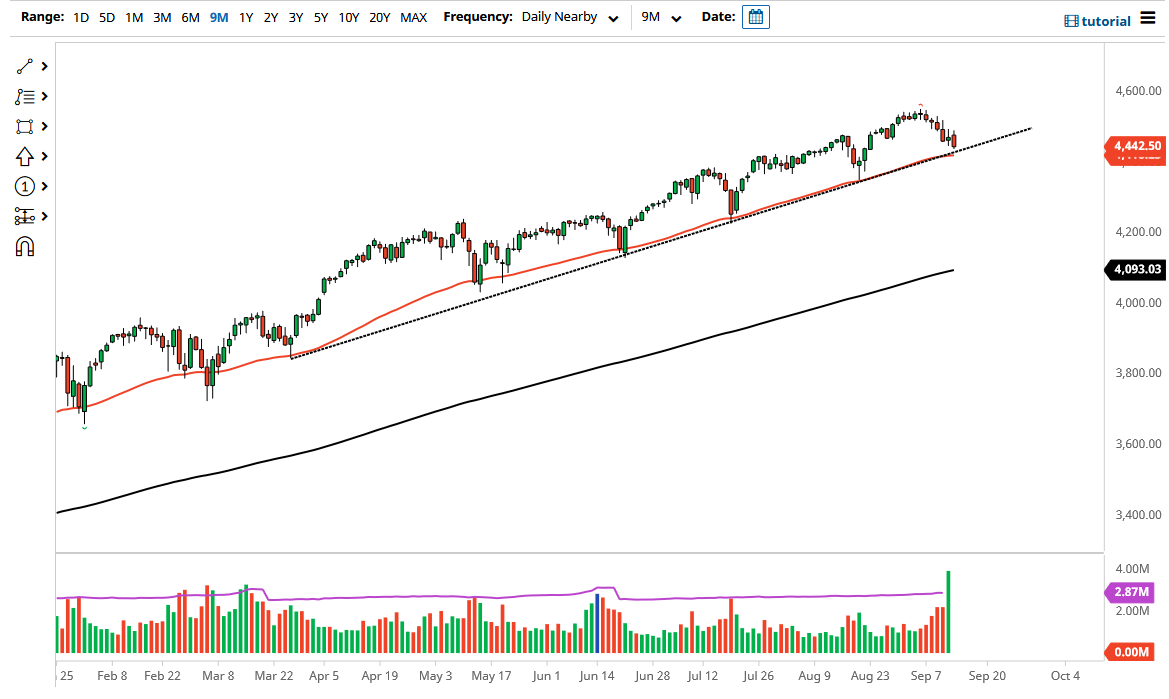

The S&P 500 fell significantly after initially trying to rally on Tuesday. The uptrend line is an area that a lot of people will be paying close attention to, especially as the 50-day EMA has been walking right along it. After that, we also have the 4400 level which will attract a certain amount of attention also.

The fact that the market is closing at the absolute lows of the trading session suggests that we are going to see an attempt to break down through the 50-day EMA, which could open up a move to much lower pricing. At that juncture, the market is one that I would buy puts in, but I would not be short of, as the Federal Reserve will do everything it can to protect Wall Street. After all, the Fed has been caught manipulating the market for its own gains as of late, although they deny it. That being said, the S&P 500 is something that they pay close attention to, so if we do drop 10% or so, that will spark serious action.

On the other hand, if we were to turn around and break above the top of the candlestick, then it is likely we will go looking towards the 4500 level, and then eventually the 4600 level after that. The market is likely to continue to move in 200-point increments, meaning that the 4600 level makes sense. That being said, this is a market that has been a “buy on the dips” type of situation for some time, and the fact that we have turned around so rapidly during the session suggests that we do have a lot of concerns out there.

Like I suggested previously, I could buy puts, but shorting this market is something that I simply cannot get behind due to the fact that every time you have tried to do so over the last 13 years, it quickly turned around. Furthermore, the fact that inflation is lower than anticipated due to the CPI figure during the session should eventually have people are focusing on the fact that the Federal Reserve is not going to be tightening anytime soon.