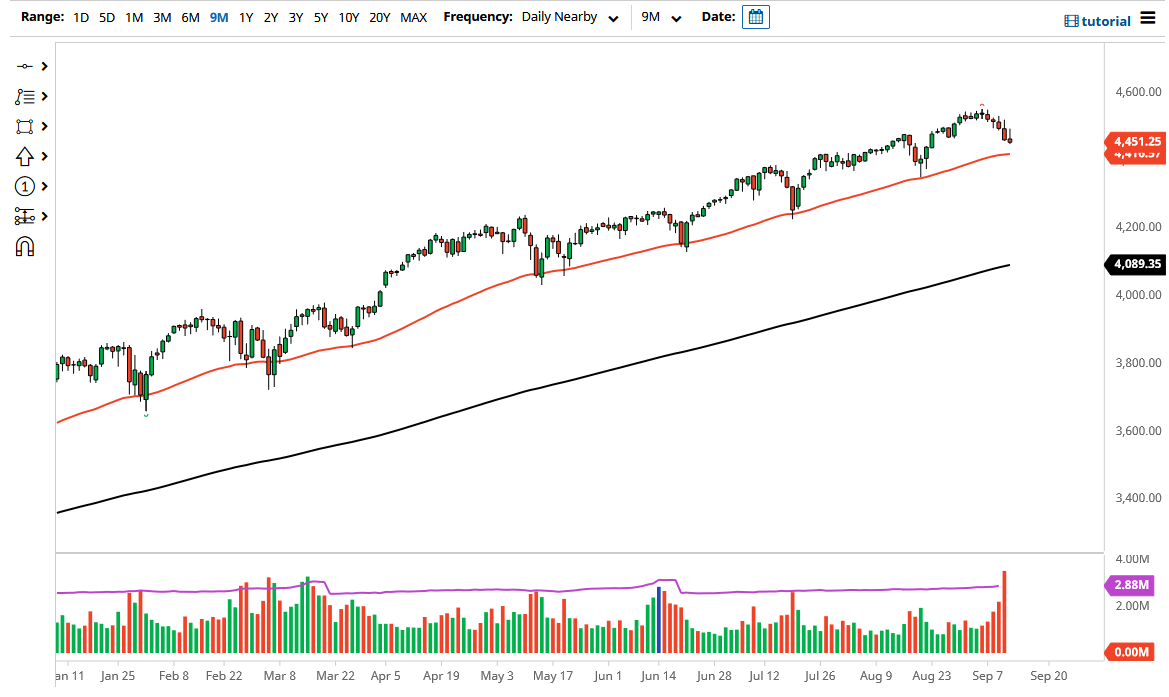

The S&P 500 gave up early gains to show signs of weakness yet again by forming a bit of an inverted hammer. That is a nasty-looking candlestick, but at the end of the day it is still a market that has plenty of buyers underneath it, and because of this I have no interest in trying to short this market. In fact, the 50-day EMA underneath should offer plenty of support, which sits just above the 4400 level. Speaking of the 4400 level, this is a market that has been supported by the Federal Reserve for as long as I can remember, and I just do not see that changing anytime soon.

When you look at this chart, you can even make a strong argument for a 45° uptrending channel that should maintain its overall strength. Because of this, I am waiting for a buying opportunity, but I do not see it based upon the candlestick for the trading session on Monday. If we were to continue falling and then turn around to form signs of life again, then I might be willing to get long. I would love to see something along the lines of a hammer sitting right at the 50-day EMA, but we will have to wait to see whether or not that is what we get. Alternately, if we do turn around and break above the top of the inverted hammer for the session on Monday, that is also a bullish sign and could send us looking towards the highs again. Because of this, I think it is simply a matter of playing the “waiting game” and seeing when we will finally get the opportunity to get long.

If we do break down below the 4400 level, then I might be convinced to start buying puts, but I will not short this market. The Federal Reserve has shown us multiple times that they are more than willing to step into the market via bond buybacks or simple jawboning in order to get traders bullish again. Because of this, it is simply a matter of waiting for an opportunity. I do not see that at the moment, but I will let you know as soon as I see an opportunity to start buying again. If we were to break down significantly I might be a buyer of puts, but that is about it.