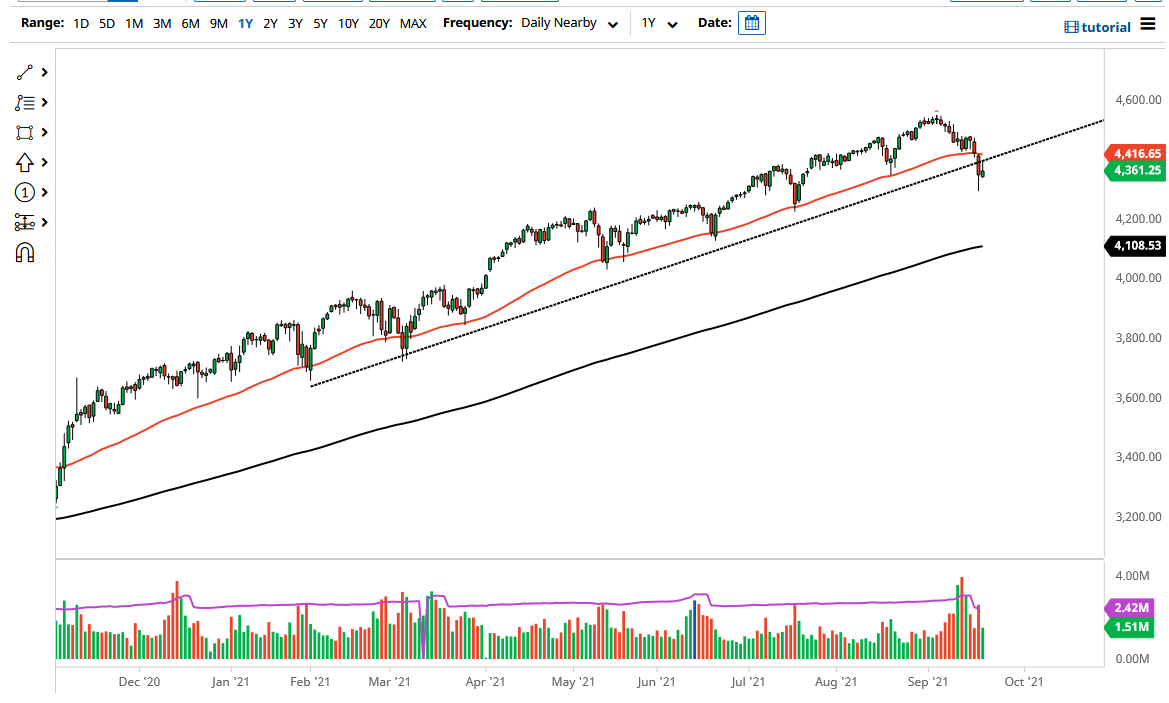

The S&P 500 rallied a bit on Tuesday but turned around as we hit the previous uptrend line. The market looks as if it is struggling to find direction, and it must be noted that the action during the session was noisy to say the least. I am paying close attention to the 50-day EMA, because if we can break above the top of the 50-day EMA, then it could open up more buying pressure to send this market looking towards the 4525 level again.

Looking at this chart, if we break down below the Monday candlestick, then it is possible that we could go looking towards the 4200 level, an area that is now starting to attract the attention of the 200-day EMA and could be where we end up with the indicator over the longer term. With this being the case, then I think it is only a matter of time before we see value hunters coming into this market, and that would be a significant area that a lot of people would be looking at. Between now and then, I could be a buyer of puts, but that is about as aggressive as I get in this market.

If we turn around and break above the 50-day EMA, then we could see a lot of momentum jumping into the market. The market will go higher over the longer term, as everybody knows the Federal Reserve will do everything it can to keep Wall Street profitable. In fact, we have recently seen stories about how various Federal Reserve governors have conflicted interests when it comes to the stock market. This explains a lot of the behavior over the last 13 years and the feeling that “the game is rigged.”

At this point, the only thing you can do is buy puts if you are seeing negativity, because it is only a matter of time before somebody at the Fed says or does something to boost Wall Street. Furthermore, this is a pullback in what is a longer-term uptrend anyway, so that is how you have to play it: a simple pullback. The market continues to be noisy, but I do think it is only a matter of time before we go higher.