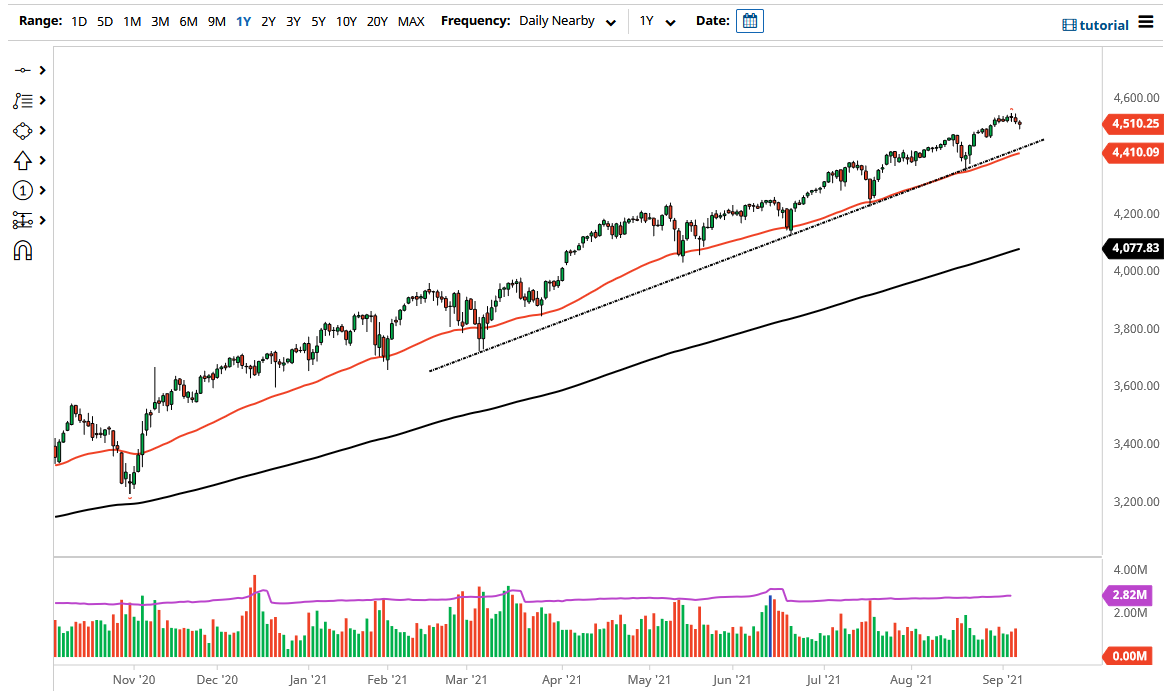

The S&P 500 pulled back towards the 4500 level only to find buyers in that general vicinity. By the end of the day, we ended up forming a hammer but none of the action over the last couple of weeks has been overly impressive, and I do think that some type of pullback is necessary. With that, I do not necessarily want to short this market, I just recognize that something needs to give.

The Federal Reserve is putting $875 million per hour into the bond market, so that means that people are jumping into the stock market looking for some type of return. Yes, this will end in tears. However, it is unlikely to end anytime soon and that is really all you need to pay attention to. The game has been the same since the Great Financial Crisis, simply buying dips going forward as the Federal Reserve will make sure that the major indices do not lose too much. I hate to sound so cynical, but at the end of the day this is really what has been keeping the market going for most of the last decade or so.

Underneath, the 50-day EMA is hugging the uptrend line, so I think that at this point we are more than likely going to see that area offer significant support, and with that being the case, the market is more than likely going to find plenty of buyers. However, if we break down below that level then it is likely that you can buy puts, but that is about as aggressive to the short side as you should be, as the Federal Reserve will step in if we see more than a 10% correction. Ultimately, this is a market that continues to be very noisy, but we need to see some type of value at this point. Although I would not short the market, I do not necessarily feel the need to jump in and start buying at these elevated levels. It looks like we are trying to find some type of catalyst, which we do not have at the moment. If you do get involved, keep your position size small and then add as it works out in your favor.