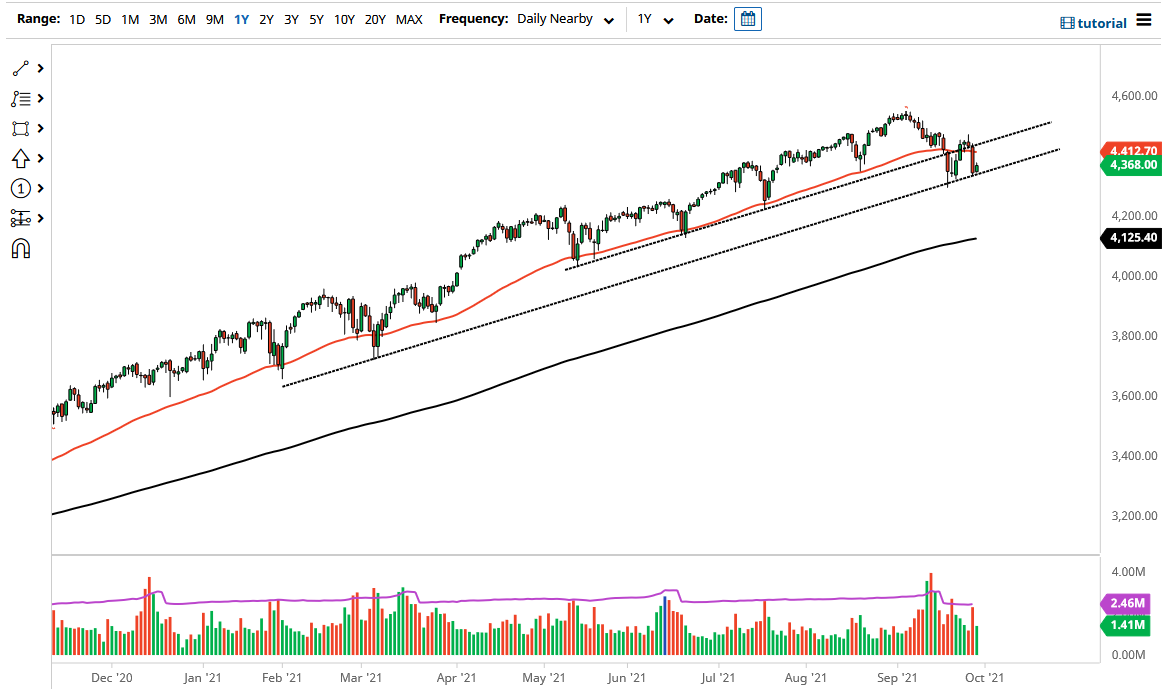

The S&P 500 rallied a bit on Wednesday to show signs of life at a previous uptrend line. The uptrend line is something that a lot of people will pay close attention to, so it is not a huge surprise to see that the market has rallied around it slightly. That being said, the market is likely to pay close attention to this uptrend line, and if we do break down below it, and perhaps more importantly the lows of the previous week, then the market will continue to go much lower, perhaps reaching towards the 4200 level. If we do break down below the bottom of the previous week, I will be a buyer of puts, looking for that bigger move to the downside.

On the other hand, if we turn around and rally, we could go looking towards the 50-day EMA, which is currently at the 4412 level. If we were to break above that level, then it is likely that we will test the shooting star from Monday. If we break above there, then the market is likely to go much higher. In general, this is a market that has been hanging onto a trendline, but the fact that we have sliced through the 50-day EMA suggests that we are certainly going to see a little bit of negativity.

The market is likely to continue seeing a lot of noisy behavior and negative behavior, due to the fact that interest rates in America are rising. That typically means that we are going to see more downward pressure on stock markets, as it becomes easier to hang onto a guaranteed investment instead of taking the risk of that stock market.

The downside is somewhat limited, and the Federal Reserve will support this market given enough time. The bond purchases and the jawboning of the market will continue to support this index. That has been the play for the last 13 years, so I think that we will continue to buy on the dips over the longer term, but in the short term we may have quite a few problems going forward. That being said, if we break above the shooting star from earlier this week it is very likely that the momentum will continue to pile on too.