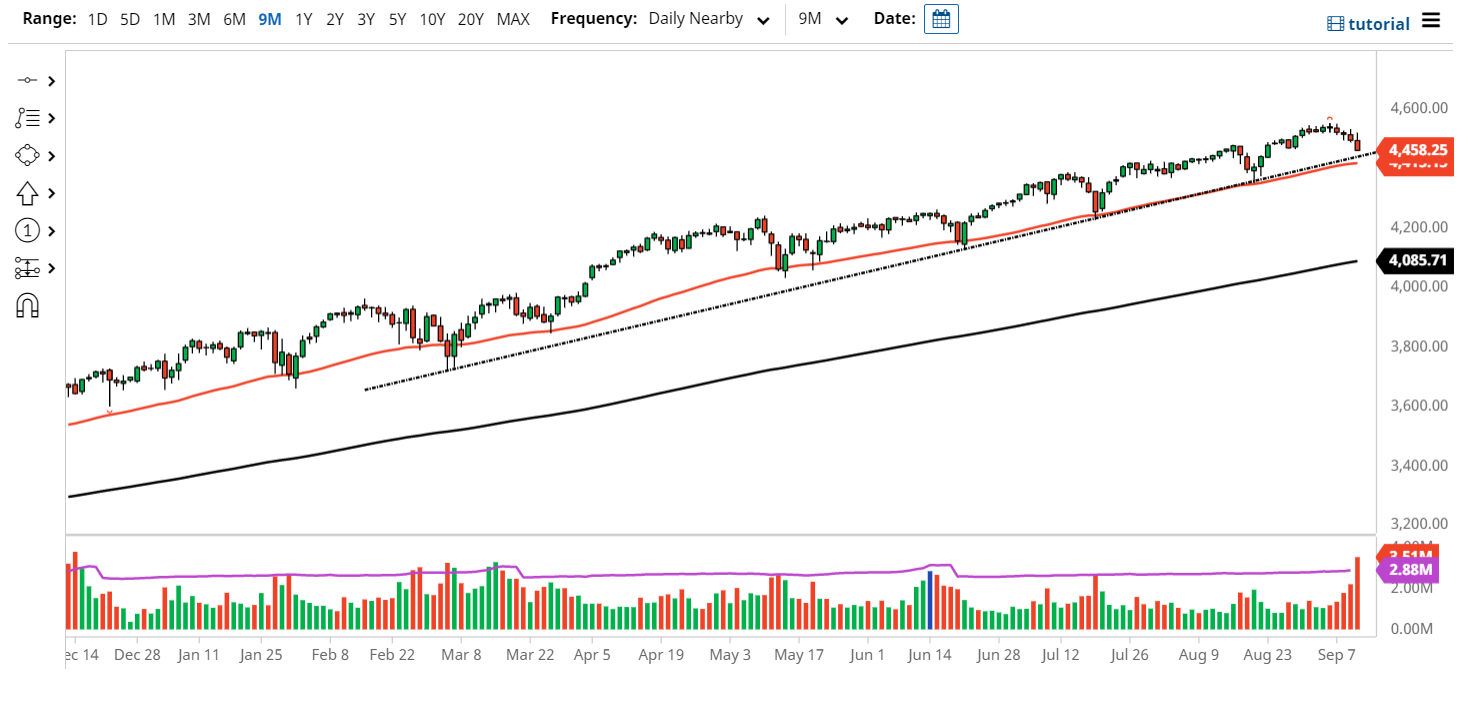

The S&P 500 initially tried to rally on Friday but gave back the gains to fall yet again. This is the fifth negative day in a row, after the all-time high that was made on Monday. The shape of the candlestick does suggest that we are going to go lower, but we also have a major uptrend line and the 50-day moving average sitting just below there that has been respected multiple times in the past.

While the candlestick on Friday is rather ugly, the reality is that it was also options expiration, which would have a certain amount of influence on the behavior. At this point, I have to assume that the uptrend line will hold, right along with the 50-day moving average. At this level I would anticipate that buyers may come back in on a value proposition, but if we do break down below those two support levels, then I would start to be a buyer of puts, as I do not short US indices due to the fact that they are so heavily manipulated by the Federal Reserve via jawboning and buy back purchases, etc.

The market breaking above the top of the candlestick could open up a move back towards the highs, but we obviously need some type of catalyst to make that happen. The markets have been in desperate need of a pullback, as we have not had a 5% correction in ages. Beyond that, the narrative is that it is coming rather soon, so I think a lot of people are starting to take profit. Ultimately, the perfect recovery after the pandemic has probably been priced in, so I think that gains from here will be a bit tougher than they had been in the past. the market could drop 10% and still look very healthy at this point. The 200-day EMA sits just below the 4100 level, so I think that's probably going to be about as bad as this could get, even in the worst of situations. Pay attention to the US dollar, it could have its influence as well, as a strengthening greenback sometimes works against the value of the stock market. Monday should give us clues as to where we go next.