The S&P 500 fell significantly on Tuesday as we continue to test the downside based upon fear and interest rates rising in the United States. Higher interest rates make stocks a little less attractive, but at the end of the day it does not necessarily drive this market longer term. After all, the Federal Reserve will do whatever it can to keep Wall Street whole, and thereby give it an opportunity to make money. The Federal Reserve will either jawbone the market or do something involving bonds to make stocks more attractive, so I think that any pullback at this point in time is probably somewhat limited.

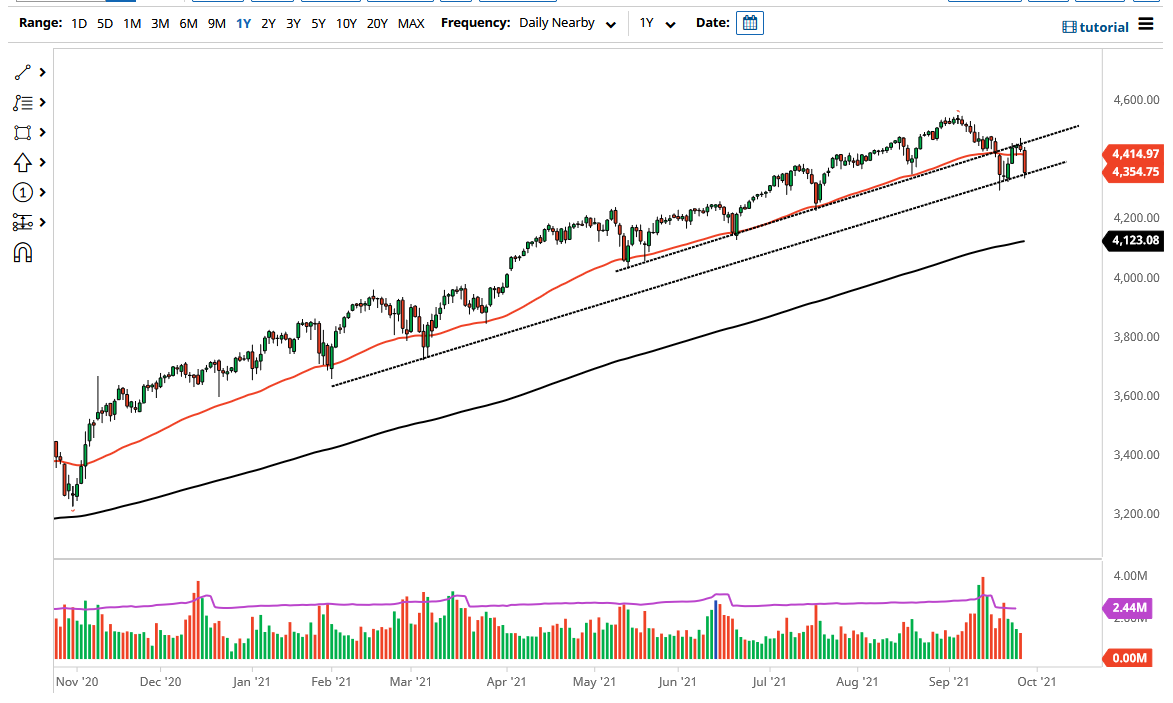

The S&P 500 has been in an uptrend for quite some time, and it makes sense that we will eventually find value hunters. If we fall from here, then the 200-day EMA sits at the 4123 level, and at this point I think the 4200 level is also an area that people will pay close attention to, as it is a large, round, psychologically significant figure. With that in mind, I think that what we are going to see is a lot of put buying opportunities on breakdowns, but shorting is almost impossible.

If we were to break down below the 200-day EMA, it would only be a matter of time before the Federal Reserve gets involved and therefore, I would be looking for signs of stabilization or a bigger reversal candle to get long again. That has been the game for 13 years, and I just do not see that changing anytime soon. The explosive move to the downside certainly causes a certain amount of downward anticipation, but I think that any pullback probably only offers opportunity from the longer-term standpoint. Beyond that, people are looking at the situation in China, as it is starting to weigh upon risk sentiment around the world. That being said, there is also the possibility of the people run back into the bond market to drive down interest rates. That makes the “growth stocks” much more interesting. If we break above the highs of the trading session on Monday, then it is likely that we will continue to go looking towards the 4600 level. I am a buyer of puts on the downside, and a buyer of contracts on the up.