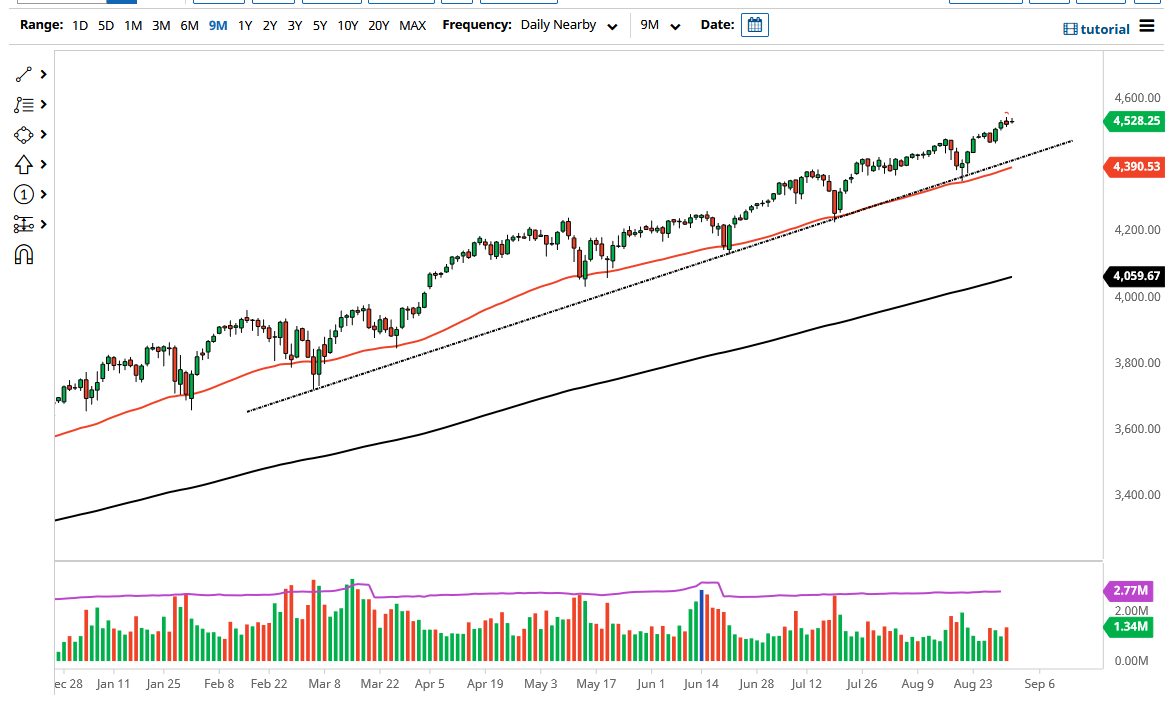

The S&P 500 initially tried to rally a bit on Wednesday but gave back the gains as sit on the sidelines and wait for the jobs figure on Friday. The 4500 level has been an area of interest, and I think it makes sense that we would see this market look at that as short-term support. That being said, we could break down below there and still be very much in an uptrend. After all, you can see that there is a massive uptrend line and the 50-day EMA walking right along that has been very reliable. As long as we stay above there, it is likely that we have plenty of buyers and go long again.

If we were to break down below the 50-day EMA, then I might be a buyer of puts. However, I think that would be a very short-term type of opportunity, and one that I would use puts to express that move rather than to short the market, because the Federal Reserve will get involved sooner or later. At this juncture, I believe that we are looking at a scenario where the market will remain bullish as long as the Federal Reserve is willing to support it, and the Federal Reserve is probably going to support Wall Street forever. Do notget me wrong, someday this game will end, but right now it is one that you do not dare short.

To the upside, I believe the 4600 level would be a significant area that we could be looking to get to, but I also recognize that the market has to pay more attention to the jobs number over the next couple of days than anything else. In other words, we are probably not quite ready to get overly long or short of the market, and I anticipate that the next 48 hours will probably be choppy and sideways more than anything else. In fact, Thursday is probably better off just being left alone, as I just do not see the catalyst to get moving. Not only do we have the jobs number on Friday, but we have a serious lack of fundamental news on Thursday that will keep this market relatively quiet. That being said, we are in an uptrend and that is all the truly matters over the longer term.