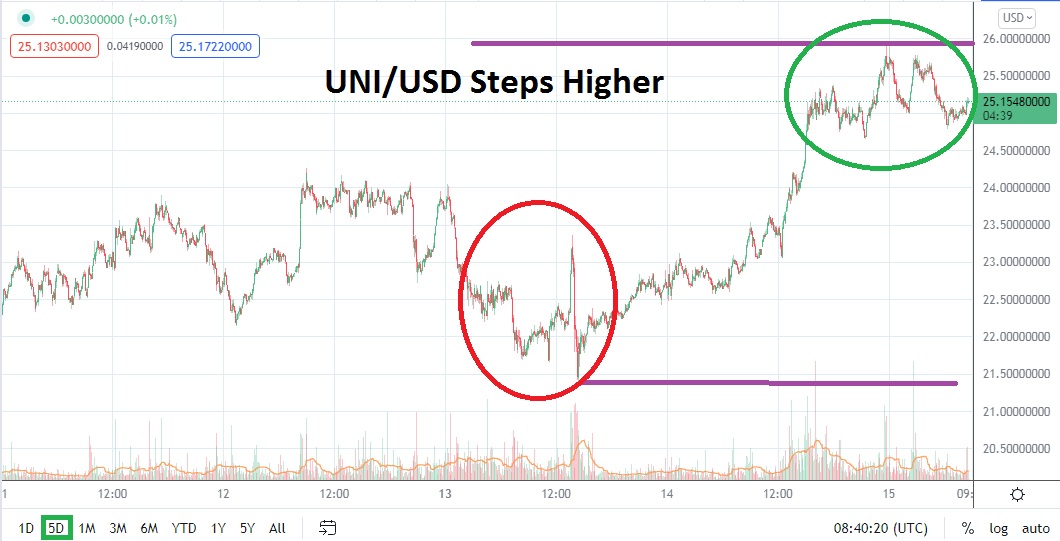

After touching a low of nearly 21.20000000 on the 13th of September, UNI/USD was able to climb to a high of nearly 26.00000000 in early trading this morning. However, after touching this important juncture, UNI/USD has seen a slight selloff emerge and now the 25.00 USD mark is being traversed. Resistance near the 26.00 USD mark is significant technically. From the 5th of August until the 7th of September, UNI/USD traversed a range between 26.00000000 and 31.45000000 rather consistently.

The broad cryptocurrency market has turned in a slightly positive trading session the past day and this has been correlated within Uniswap. Like the other major digital assets, UNI/USD dropped to an important low on the 20th of July with a value of nearly 14.00 USD tested. The bullish trend higher since the third week of July marched in formation and UNI/USD touched a high of approximately 31.45000000 on the 1st of September.

Uniswap is the 11th biggest cryptocurrency via its market capitalization ranking with close to 15.3 billion USD in value. Technical traders will want to keep their eyes on the 26.00000000 mark as resistance in the short term; if this level is able to be penetrated higher, it could mean a potentially strong buying spree is about to be engaged near term. However, nervous sentiment has been evident in the broad cryptocurrency market and speculators will want to keep their eyes on Uniswap’s major counterparts too.

Short-term support near the 24.50000000 to 24.16000000 levels should be watched carefully. If these junctures falter and are penetrated below, this could indicate that selling momentum in UNI/USD is actually more of a danger. While a low of nearly 21.20000000 was experienced yesterday and held, if this lower value were to be seriously challenged support levels not tested since late July and early August could be targeted.

Uniswap has enjoyed a significant bullish run higher since the third week of July, but its early September highs did not challenge the apex all-time marks within UNI/USD which were produced in early May when the cryptocurrency traded above 45.00 USD. Traders who remain optimistic regarding UNI/USD may want to remain cautious until the 26.00000000 mark above is proven vulnerable. Until then, traders may actually want to try and sell Uniswap on slight reversals higher which do not break through current resistance levels.

Uniswap Short-Term Outlook

Current Resistance: 26.10000000

Current Support: 24.16000000

High Target: 28.20000000

Low Target: 21.09000000