The US dollar has been fluctuating against the Canadian dollar over the last couple of days, as we are simply hanging around the 200-day EMA. This is not a huge surprise, due to the fact that the jobs number comes out on Friday, and we need to take a look at the crude oil markets themselves which are starting to show signs of hesitation. If that continues to be the case, then we could see the Canadian dollar suffer as a result. The market continues to see a lot of noise when it comes to crude oil, as we see OPEC looking to extend production, so it is likely that the crude oil markets may continue to struggle.

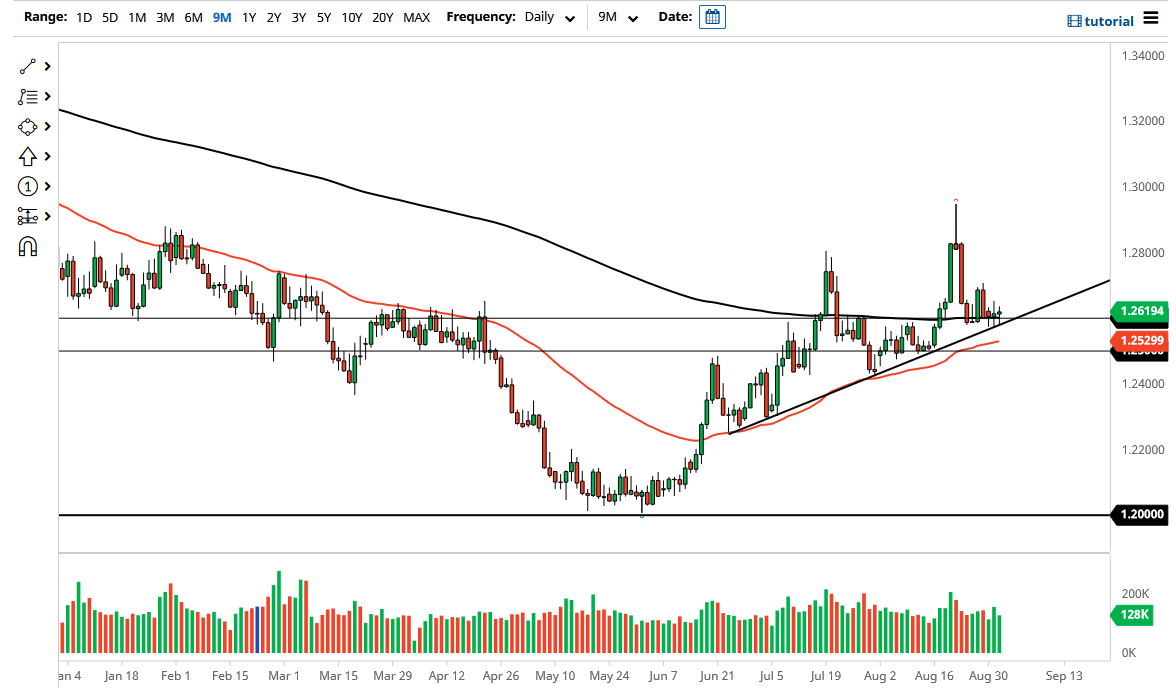

Furthermore, we have seen less than exciting industrial numbers from around the world, which could have a negative influence on the Canadian dollar itself. Beyond that, people are starting to try to price in the idea of tapering from the Federal Reserve, which could be positive for the greenback. Beyond that, the 200-day EMA has been sitting right in the same area as well, so it is likely that a lot of technical traders will be paying close attention to that region. Furthermore, the 50-day EMA is starting to reach to the upside, perhaps getting ready to figure out the “golden cross” next.

The 1.26 level is supportive, extending all the way down to the 1.25 level. With this, you should also pay close attention to the uptrend line, which is a very supportive concept as well. After all, it looks as if we have been simply walking along this chart region for a while, and the market is likely to continue to move in the same general direction. However, if we were to turn around and break down below the 1.25 handle, then it is likely that we could break down significantly to reach towards the 1.24 handle, and then possibly even down to the 1.22 level. After that, then the 1.20 level comes into the picture, which was massive support on the longer-term charts, and as a result one could say that we have already tested a major bottom of the market and we could be getting ready to turn around. In general, this is a market that will probably be choppy over the next couple of days.