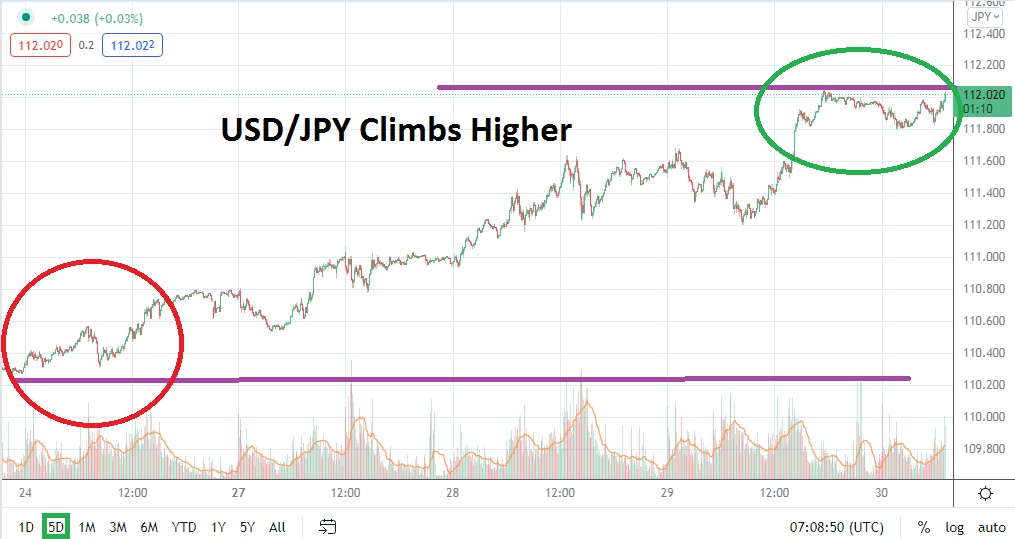

The USD/JPY continues to display an ability to achieve higher ratios and sustain its bullish trend which is now testing long-term highs. In the past week of trading, the USD/JPY has climbed from 109.800 on the 23rd of September up to 111.900, which the Forex pair is traversing today.

A high of 112.050 approximately was touched earlier today and the USD/JPY remains abundantly within the upper realms of its value. Short-term day traders may want to take a look at 5-year charts to get a technical perspective regarding the last ventures within the current price ratios being produced.

In April 2019 and January of 2020, the current values being displayed by the USD/JPY were being traded. However, it hasn’t been since September 2018 until December 2018 that the pair saw a sustained amount of trading within this higher price band. During that long time ago duration, a high of 114.000 was seen a handful of times. Technically, if the 112.200 ratio is tested in the short term, the USD/JPY would in essence then be within a trading realm that is a vacuum technically, unless it is compared to long-term charts.

The USD/JPY has been trending higher in the month of September and it continues to incrementally brush aside resistance levels. Last week’s FOMC statement from the US Federal Reserve certainly caused a reaction in Forex and the USD/JPY has acted in correlation to many of the other major Forex pairs which have seen the USD get stronger. While some speculators may be tempted to look for reversals lower, it needs to be pointed out that it is often perilous to stand in front of an oncoming train.

Traders who want to try and pursue the prevailing trend may want to wait for slight pullbacks in the USD/JPY to ignite their long positions. Take profit orders should not be overly ambitious, but the 112.050 to 112.150 ratios may prove to be close enough for speculative wagers. Traders who use a conservative amount of leverage and can widen their stop losses below could find that this allows for their trades to withstand small reversals lower if they occur. Buying the USD/JPY appears to be a worthwhile wager near term.

USD/JPY Short-Term Outlook

Current Resistance: 112.250

Current Support: 111.600

High Target: 112.900

Low Target: 110.970