The USD/JPY has settled around the 110.00 psychological resistance as USD pairs anxiously await the US jobs numbers tomorrow. The highest gains during this week's trading were the 110.41 resistance level, a 2-week high, before settling around the 110.10 level as of this writing. this comes as the pair anticipates the announcement of the US trade balance figures, weekly jobless claims, non-farm productivity, and statements by some US monetary policy officials. All in all, the US dollar tried to get back on its feet in the middle of the week's trading, but it could risk a fresh loss ahead of the weekend if Friday's jobs report or other pending economic numbers give the Federal Reserve a reason to delay the expected September cut of the quantitative easing program.

Some dollar exchange rates found stability in the short-term at least on Wednesday as selling appeared to have eased after more than a week of nearly continuous declines for the US currency, with the British pound stalling around the week's opening level above 1.3750. However, the euro advanced against the dollar along with the Australian and Canadian dollars, which resulted in a partial loss for the US Dollar Index for the session that was on its way to eroding an important level of technical support around 92.65 for the US Dollar Index.

The US dollar has reached an inflection point from which it can either renew the losses seen in the last two weeks or try to recover, and this week's August Non-Farm Payrolls report and ISM surveys will be decisive in either direction. The US dollar fell strongly in the wake of last Friday's speech from Federal Reserve Chairman Jerome Powell at the Jackson Hole Symposium.

Commenting on this, Valentin Marinov, FX Analyst at Credit Agricole CIB says: “The US dollar is still healing its wounds in the wake of the central bank seminar in Jackson Hole.” He added, “Potential positive surprises from the releases, especially labor market data, could strengthen the outlook for the US dollar. Meanwhile, any deterioration in global risk sentiment on the back of concerns over the negative growth impact of the delta variant may now be less positive for the US dollar if it is seen as delaying Fed policy normalization.”

Jerome Powell confirmed last Friday that the US economy is making light work of "incremental significant progress" toward full employment that the bank is seeking as a precondition for starting to end its quantitative easing program, but cautioned that we will "carefully assess incoming data and evolving risks" before making any decision on the system.

Analysts have pointed to this as something likely to delay the tapering decision, but it may also be important for the dollar that Powell warned that the economy would have to pass a "different and significantly more stringent test" before the Fed raised rates.

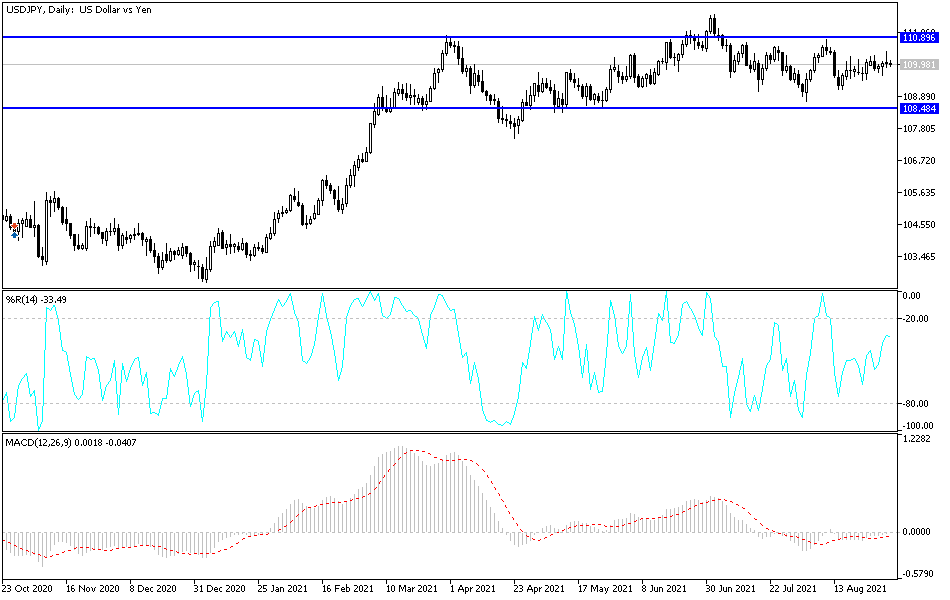

Technical analysis of the pair

Since there is no change in the performance, there is no change in the analysis, as the stability of the USD/JPY currency pair remains around and above the psychological resistance at 110.00, motivating the bulls to control the performance and increasing the technical purchases to move towards higher and closer levels, such as 110.65 and 111.20. On the downside, the currency pair may abandon its current bullish view if it moves towards the 109.55 and 108.80 support levels.

I still prefer buying the currency pair from every dip.