Since the beginning of the week, the USD/JPY has settled around the 110.00 psychological resistance, also hitting the 110.45 resistance and settling around 110.05 as of this writing. This move comes ahead of the announcement of the number of US weekly jobless claims and statements by a large number of monetary policy officials of the US Federal Reserve, at a time when the markets are hungry for their opinion after the disappointing numbers of US jobs.

Yesterday, New York Fed President John Williams said the labor market should see further progress to get closer to the central bank's maximum employment target. Among what was mentioned in the Beige Book, the Federal Reserve said that the US economy "slightly declined" in August due to an increase in coronavirus cases. This has led to a decline in eating out, travel and tourism in most parts of the country.

The Beige Book, a collection of anecdotal evidence of economic conditions in each of the 12 federal provinces, said the slowdown in economic activity was largely attributable to declines in eating out, travel and tourism in most regions. The slowdown in those sectors reflected safety concerns due to the rise of the delta variant of the coronavirus and, in a few cases, international travel restrictions.

At the same time, the Federal Reserve said that other sectors of the economy in which growth slowed or activity declined were those constrained by supply disruptions and labor shortages, as opposed to falling demand. "In particular, the weakness in auto sales is broadly attributed to lower inventories amid the ongoing microchip shortage, and the restriction of home sales activity is attributable to reduced supply," the Fed said in its statement.

The book also mentioned that US inflation has stabilized at a high rate, with half of the states describing the pace of price increases as strong, while half of them described it as moderate.

China's regulatory crackdowns on nearly all sectors of the economy are affecting investor sentiment. In another development, rating agencies say Evergrande Group, one of China's largest property developers, is increasingly likely to default on its debt after news reports that it will delay interest payments on bank loans. The company is selling assets to raise cash and is facing complaints about delays in paying contractors and delivering projects to clients.

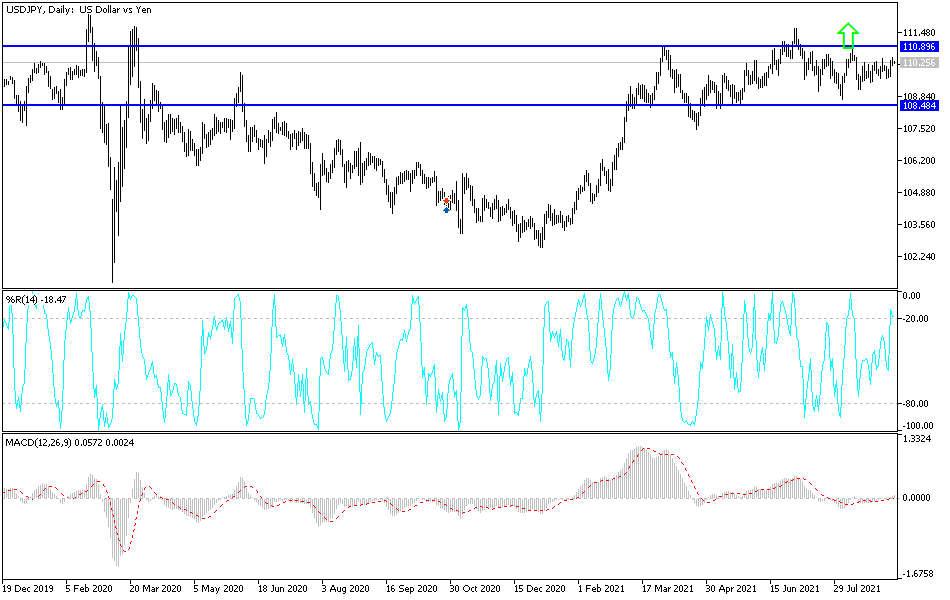

Technical analysis of the pair

Despite the stability of the USD/JPY currency pair around the 110.00 psychological resistance, bulls still need more momentum to move towards the resistance levels at 110.65 and 111.20 to confirm the strength of the upward move. On the daily chart, the support levels 109.65 and 108.80 are still legitimate targets for the bears in case the currency pair does not get more bullish momentum for a prolonged period.