Amid bearish pressure and sell-offs, the USD/JPY pair will see the US Federal Reserve's policy decisions today. The recent pressure pushed the currency pair towards the 109.11 support level in early trading today, which coincided with the Bank of Japan's announcement of its monetary policy decisions, while keeping interest rates and the policy path unchanged. The currency pair is stable around the 109.60 level as of this writing. Commenting on the performance of the US dollar, Richard Pace, a Reuters analyst, said: “Although risk aversion has abated for the time being, the continued appeal of the safe haven of the US dollar will limit its setbacks while markets remain cautious, as well as fears of a tougher surprise from the US Federal Reserve today."

The question that investors want answered is how the Fed intends to approach the end of its quantitative easing program. Many are anticipating an announcement today as all roads point to a "gradual decline" starting in December. Accordingly, Juan Prada, an analyst at Barclays Bank, says: “Despite slowing domestic demand and rising cases of the coronavirus, we believe that concerns about supply bottlenecks and uncertainty about the inflation outlook will make the Fed tend to deteriorate sooner rather than later.”

Perhaps most important to the markets will be the release of updated forecasts from the Fed as to where committee members see interest rates in the coming years. The answers to these questions ultimately lie in the Fed's assessment of the recent slowdown in economic growth.

Investors still expect the Fed to signal its intention to taper gradually this week, but it won't start before the end of 2021, so the risk of a hawkish surprise and a stronger US dollar is tied to future expectations about interest rates from committee members today.

The consensus expects one rate hike in 2022 and two in 2023, and as such “it would take the points to show two hikes in 2022, or four or more in 2023, to generate a hawkish reaction. There is a fair amount of uncertainty regarding the economic outlook given the rising cases of COVID-19 in the US, weak global stock markets and severe inflation.

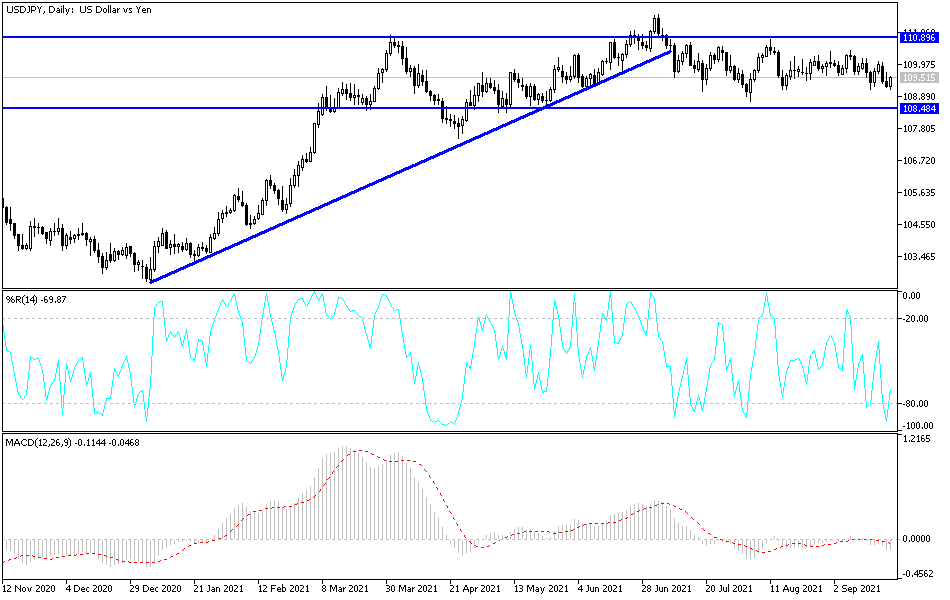

Technical analysis of the pair

Despite the recent selling of the USD/JPY pair, it still has a chance to rise, as it is the closest so far to breaching the 110.00 psychological resistance, which is vital to increase the buying to move towards stronger resistance levels. If this happens, the most important resistance levels will be 110.65 and 111.20. In the current bullish path, the 108.80 support will confirm the strength of the bears' control and at the same time motivate Forex investors to think about buying the currency pair.