The USD/JPY is still trying to break through the 110.00 psychological resistance to complete the upward correction. The bears tried several times to breach the 109.60 support level, but it was attracting investors to buy. Investors are back in safe haven buying as news that the US will pressure China on support worsened risk sentiment.

As a result, major equity markets gave up gains as investors scaled back exposure following news that the Biden administration wants a new investigation into Chinese subsidies and their damage to the US economy. Bloomberg reports that the move was a way to put pressure on Beijing over trade, raising concerns among investors that a deterioration in relations between the world's two largest economies is looming.

Despite the last performance, analysts at HSBC say that the macroeconomic background, the divergence of the US central bank and the situation of investors all point to further advances by the dollar, especially against the euro. “We believe that the US dollar is gradually moving to a stronger path due to moderation in global growth and the Fed is approaching an eventual rate hike,” says Paul McKelle, head of research at HSBC.

However, this article was published on the day the dollar became much softer against the euro, sterling and other major currencies in price action suggesting that clear directional trends will remain out of reach.

The US dollar's weakness coincides with the backdrop of broadly positive investor sentiment ahead of last weekend, highlighted by rising stock markets and commodity prices. The dollar has benefited in 2021 when investor sentiment is on the upswing and liquidation of positions increases demand for the highly liquid dollar.

But the dollar's value rose during the middle part of the year as another driver dominated investor rhetoric: the timing of the withdrawal of monetary support from the US Federal Reserve.

Investors have steadily boosted expectations that the Fed will announce that it will begin ending its quantitative easing program by the end of the year, a target that still appears to be sound. However, US Federal Reserve Chairman Jerome Powell's speech at the Jackson Hole seminar confused some in the market after he made it clear that ending quantitative easing would not call for a rate hike soon after. The dollar's decline confirmed that interest rates were key to determining value and focusing on the timing of the taper was just trying to get a better understanding of when the first rally might drop. The US interest rate hike may be further away than previously expected, dragging the US dollar since the speech.

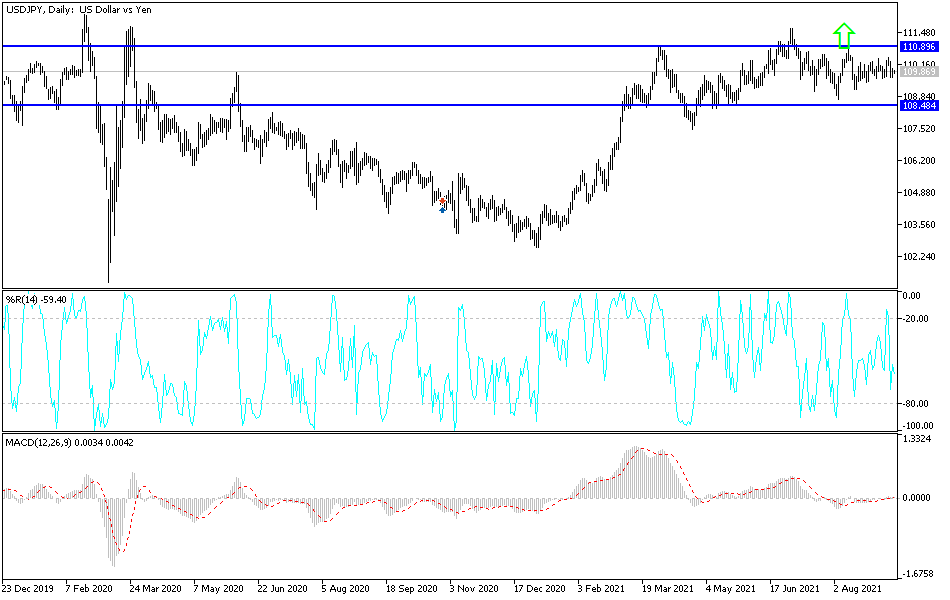

Technical analysis of the pair

For bulls to dominate, the USD/JPY must move towards the resistance levels at 110.65 and 111.20. On the daily chart, the performance appears to be neutral, awaiting catalysts for one of the two directions. On the other hand, the bears will regain control of the trend if the pair moves towards the support levels at 109.55 and 108.80. The last level may be good for buying.